The Rising Cost of Settling the American Desert

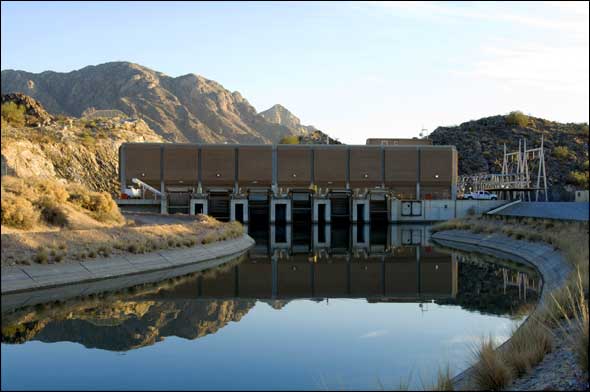

Power Plant That Moves Torrent of Water Uphill Considers Closing

By Brett Walton

Circle of Blue

In 1968, when Interior Secretary Stewart L. Udall replaced two dams in the Grand Canyon with an agreement to build a huge coal-fired power plant on the Arizona-Utah border near Page, he viewed the pact as one of the last steps in what he called “water statesmanship,” to resolve “the overwhelming political issue in Arizona.” When it was completed in 1974, the new 2,250-megawatt Navajo Generating Station (NGS) provided the power to draw 1.42 billion gallons of water a day out of Lake Havasu, along the border with California, and pump it 336 miles and nearly 3,000 feet uphill in the Central Arizona Project (CAP) canal all the way to Tucson.

— David Modeer

In almost every way conceivable, the power plant and the canal reflected the hubris of a rich nation at the height of its wealth, and determined to build in one of the driest regions on the continent energy-hungry and water-wasting cities that defied the laws of nature. Nearly four decades later, in an era marked by the warming climate, the increasing financial and environmental costs of generating power with coal, and declining reserves of fresh water in the West, the historically tenuous cords of legal agreement and civic support that have always defined the CAP are threatening to come unraveled.

At the core of the problem is the price of water, which is closely tied to the cost of operating the plant. Both could rise substantially if the Obama administration and the U.S. Environmental Protection Agency issue new rules to limit emissions of carbon dioxide and other haze-producing gases. There is also a drought that has persisted for more than a decade on the Colorado Plateau, raising a serious question about how much Colorado River water will be available to both cool the giant power plant, and also supply the CAP’s farm and business customers, and 80 percent of Arizona’s residents.

In other words, say executives of the CAP, the 36-year union of cheap energy and cheap water is about to end, and water prices for most Arizonans could increase drastically.

“We’re very concerned,” David Modeer, general manager of CAP, told Circle of Blue. “Given the atmosphere right now, we don’t think the owners would make that decision to invest in the plant. We’re looking at possible closure by 2019.”

During the past 10 weeks, in Choke Point: U.S., Circle of Blue has described in probing detail the collisions occurring in almost every region of the country between rising energy demand and declining reserves of fresh water. Next to agriculture, energy production withdraws and uses more water than any other sector of the American economy. Choke Point: U.S. has raised urgent questions about the capacity of the United States to meet a 40 percent increase in energy demand by mid-century—a projection developed by the Department of Energy—and not exhaust the country’s freshwater reserves. The collision between water and energy is most fierce in the fastest growing and most water-scarce regions of the nation, including California, the Southwest, the Rocky Mountain West and the Southeast.

Choke Point: U.S. identified the Colorado River as a particularly telling example of how energy demand and water scarcity is producing authentic threats to the American way of life. Lake Mead, which dams the Colorado River near Las Vegas and is one of the largest reservoirs in the country, is 59 percent empty and the water level is so low that the giant turbines in Hoover Dam could soon stop turning.

Upriver, where the NGS withdraws eight billion gallons of water annually from Lake Powell, the nation’s second largest reservoir, water levels have stabilized after falling to record low levels in 2005. As a hedge against future droughts, a deeper cooling water intake was completed earlier this year, allowing the plant to draw water below Lake Powell’s dead pool — the elevation where water levels are lower than the reservoir’s outlet pipes.

The newest threat to the power plant, say its managers, is the cost of controlling emissions, particularly carbon dioxide and haze-producing nitrogen oxides.

The closure of the NGS, they say, would be a brutal blow to CAP water prices because electricity from NGS is sold at cost. Farmers would be hit especially hard, since they currently pay for water at the cost of the energy to move it — a 60 percent discount as the result of a state compromise designed to end unsustainable groundwater pumping. Using energy price forecasts from Navigant Consulting Inc., and global engineering corporation Black & Veatch, CAP analysts estimate that water prices would rise by 50 to 300 percent if they had to purchase energy at market rates.

New Standards Mean More Green

A lot of the energy produced in the United States is used to move water from its source to the treatment plant and then the end user. Energy also is needed to dispose billions of gallons of water every day. Typically, moving water is the single largest electrical expense of the nation’s cities and towns. Nationally, four percent of electricity is used to get water from one place to another.

The U.S. Environmental Protection Agency, given new vigor under the Obama administration, announced in August 2009 that it was considering regulations to reduce nitrogen oxide emissions from NGS in order to improve visibility in the region, especially in Grand Canyon National Park, 12 miles southwest. Depending on what type of technology the EPA mandates, energy costs at NGS will rise between 1 and 34 percent, said engineers.

— David Modeer

The nitrogen oxide regulations come at a time when carbon emissions are already under pressure to be priced or regulated in the United States. Though the Senate failed to pass a cap-and-trade bill this year, regional trading schemes are beginning to be floated and a national carbon price, while low on the political radar, is still possible. A carbon price of $20 per ton, which is in the middle of what the House passed in June 2009 and the Senate proposed this year, would increase CAP energy costs 71 percent. The price of an acre-foot of water (326,000 gallons) from the CAP for agricultural users would rise to $88 from $53 in 2011 prices.

The EPA also was granted authority by the U.S. Supreme Court in 2007 to regulate carbon emissions from big polluters under the Clean Air Act—which it plans to begin doing next year.

This adds up to a lot of uncertainty for CAP managers and Arizona water users. The CAP managers are not sure whether owners of the Navajo station will take on the higher costs from retrofits and the possibility of carbon prices, or shut the plant down. Executives of the consortium of utilities that own the Navajo station have been cautious in their statements. Installing new emissions control technology requires a unanimous vote of the owners. One owner, the Los Angeles Department of Water and Power, has already stated its intention to divest from coal-based energy sources by 2020.

Energy for Water

Water, at 8 pounds per gallon, is a heavy load when billions of gallons need to be lifted. As a result, the largest share of energy to move it goes toward pumping.

The longest, highest pumping systems in the United States are in the West, where water often travels great distances from source to user, nowhere more so than California. The State Water Project sends Sierra Nevada snowmelt 444 miles to the state’s southern half, and the Colorado River Aqueduct traverses 242 miles in its course. Nearly 8 percent of California’s electricity is invested in water movement, according to the California Public Utility Commission (CPUC). If you add the energy used by end users to heat water, 19 percent of the state energy is tied to water use. Meanwhile, the CPUC is looking into how much energy can be shifted away from peak demand hours by reducing water use.

“Energy costs play a big part in water rate increases,” said Jon Lambeck, power resources manager at Metropolitan Water District of Southern California.

Across the West, water managers looking to increase supplies are facing significantly higher energy costs to access that water since all of the easily available sources are spoken for. A report from Western Resource Advocates, a research group, found that the energy intensity (the energy required to move a unit of water) of most proposed new supply projects is higher than current supplies because wells will have to be drilled deeper, canals extended farther and lower quality water treated more thoroughly.

Higher energy requirements for water supplies are coinciding with a national realization that past ways of electrical generation may not be viable in a water-constrained world.

The starkest example of how old water and energy practices are bumping up against new realities is the Central Arizona Project and the Navajo Generating Station.

CAP/NGS History

In 1968, the U.S. Congress authorized the Central Arizona Project, the country’s largest and most expensive aqueduct system, to bring Colorado River water to the state’s dry center. To that point, Arizona had been unable to effectively utilize its share of the river, but reaching the inland area required pumping the water nearly 3,000 vertical feet, an energy-intensive process that would turn CAP into the state’s top energy consumer.

To provide that electricity, the U.S. Bureau of Reclamation’s preferred option was to construct bookend dams at the margins of the Grand Canyon National Park. But those plans were scuttled after a Sierra Club advertising campaign comparing the proposal to flooding the Sistine Chapel for a better view of the ceiling prompted national outcry.

The power source resolution was the Navajo Generating Station—three coal-fired boilers with a total rated capacity of 2,250 megawatts. The coal would come from Kayenta mine on the Navajo reservation 92 miles away, providing the tribe $12 million a year or most of its revenue. The Navajo Nation, moreover, receives $137.5 million annually from employment in the plant and the mine, royalties and other fees, according to the Central Arizona Project.

As the largest stakeholder in the venture, CAP receives 4.3 million megawatt-hours per year, almost a quarter of the plant’s electrical output. That is enough to meet 95 percent of its energy needs and generate an annual surplus of 1.5 million megawatt-hours that are sold on the open market to repay the federal government for construction of the canal, as well as pay for Indian water rights settlements.

In 1999, EPA established a regional haze rule, requiring no manmade visibility impairment by 2064 around national parks and wilderness areas. NGS had already cleaned up its sulfur dioxide emissions with a retrofit in 1991 and is currently voluntarily installing low-nitrogen oxide burners at a cost of $46 million in order to reduce pollutants.

While the EPA could rule that this is sufficient action, also on the table are two significantly more expensive technologies: selective catalytic reduction (SCR) and SCRs with polishing baghouses. The former would cost $550 million and increase energy costs 17 percent; the latter would cost $1.1 billion with a 34 percent rise in energy costs, according to Salt River Project, the plant’s operating partner.

The operators of NGS are in favor of the low-cost burners. They argue that the other options are too costly for marginal improvement that will not be humanly perceptible and that much of the haze comes from upstream sources outside the immediate area. The Navajo and Hopi tribes also support the operators’ position because they rely on coal mining and land leases for employment and tribal income. However, there is grassroots opposition within the tribal communities against NGS and Peabody Western Coal Company, which operates the mine, because of the health and environmental consequences of coal-mining, especially depletion of the aquifer system.

The National Park Service supports SCR technology and argues that Salt River Project overestimated the cost and underestimated the visibility improvements.

The EPA has not finished its analysis of control technologies and is still assessing submissions made during the open comment period, public affairs officer Margot Perez-Sullivan wrote in an email to Circle of Blue. There is no firm date yet on when a ruling will be made.

Modeer, CAP’s general manager, said that they are looking at alternative energy sources, but it would take 12 to 15 years to develop a base load source to replace the Navajo plant.

“The immediate concern of the Navajo Generating Station is a huge issue for Arizona,” Modeer added. “It’s a confluence of a lot of things that’s putting the station at risk. It’s not just the EPA. It’s carbon legislation, ozone issues, mercury issues. All operators are looking at the future.”

Brett Walton is a Seattle-based reporter for Circle of Blue. Contact Brett Walton

Corrections about Kayenta mine and grassroots opposition to it have been made to this article since first publication

Brett writes about agriculture, energy, infrastructure, and the politics and economics of water in the United States. He also writes the Federal Water Tap, Circle of Blue’s weekly digest of U.S. government water news. He is the winner of two Society of Environmental Journalists reporting awards, one of the top honors in American environmental journalism: first place for explanatory reporting for a series on septic system pollution in the United States(2016) and third place for beat reporting in a small market (2014). He received the Sierra Club’s Distinguished Service Award in 2018. Brett lives in Seattle, where he hikes the mountains and bakes pies. Contact Brett Walton

Comments are closed.