Deep Sea Gas: China Follows Japan in Pursuit of New Energy Source

Though methane hydrate, a newly discovered unconventional natural gas reserve, is seen as an alternative to coal-fueled power, the technology for tapping deepwater supplies is not yet viable.

By Linyi Zhang

Circle of Blue

Not to be outdone by their neighbors and rivals from Japan, Chinese scientists this summer have set out to find a potentially vast new source of cleaner-burning fossil fuels, located beneath the floor of the South China Sea.

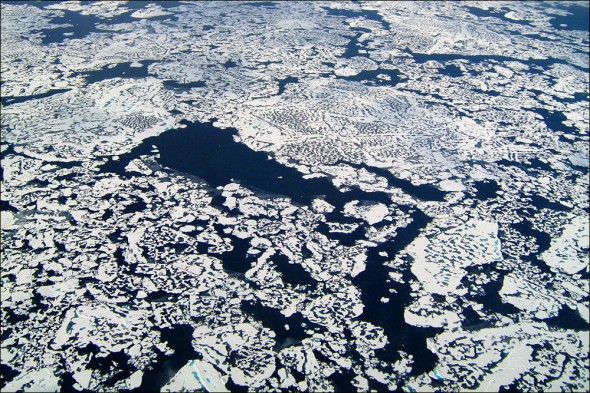

The exploration comes five months after Japan announced in March that it had extracted natural gas from a new source of energy — methane hydrate, a type of natural gas that is trapped in an ice shield and forms when methane and water combine at high pressure and low temperature — from the deepwater seabeds in the Pacific Ocean, off Aichi Prefecture. Japan has since announced that it found more than 200 other sources of methane hydrate in the seabeds surrounding the island nation.

Methane hydrate reserves have the potential to contain more energy than any other fossil fuel, according to the U.S. Geological Survey and a 2011 study by the Massachusetts Institute of Technology (MIT). Just one cubic meter of pure methane hydrate can be depressurized and warmed to produce 164 cubic meters at room temperature and ambient pressure.

Scientists estimate that 99 percent of methane hydrate reserves exist at water depths ranging from 300 meters (984 feet) to more than 4,000 meters (13,123 feet), depths that encompass much of the planet. The methane hydrates are then buried an additional 50 to 250 meters (165 to 805 feet) below the ocean floor.

With 32,000 kilometers (19,884 miles) of ocean shoreline, China is hoping to find its own stockpile of underwater methane hydrate reserves. Some Chinese experts have even compared the energy potential of methane hydrate reserves in the South China Sea to that in Daqing — China’s largest oil field, discovered in 1959 — which produced 293 million barrels of oil in 2012. That is 50 million barrels more than the shale boom of North Dakota produced in 2012, according to U.S. Energy Information Administration.

“It is unclear that hydrate production can be commercial in the short and medium term, especially in light of the recent shale gas development.”

–Ruben Juanes, associate professor

Massachusetts Institute of Technology

Still, though the potential energy reserve is high, some energy authorities are not sure that methane hydrate can be a game changer for China, especially when commercial production appears so far away.

“The recent Japan pilot — which indeed was successful — is for a particular geologic setting and hydrate play. And, even there, it is unclear whether production could be sustained at high rates and for long periods of time,” said Ruben Juanes, associate professor in energy studies at MIT, during an interview with Circle of Blue. “It is unclear that hydrate production can be commercial in the short and medium term, especially in light of the recent shale gas development. It is not easy for me to see when hydrate could play a big role in the energy mix.”

Unconventional Gas Markets

Deteriorating air quality and rising carbon emissions are driving China’s urgent shift from coal combustion, which currently makes up 70 percent of the nation’s energy consumption. China’s clean energy sector is the world’s largest, due to increases in power generation from wind and water over the last decade. Likewise, demand for cleaner-burning natural gas in China has experienced a four-fold increase over the past decade.

“Hydrates are primarily a research topic right now, but an interesting one.”

— Tim Collett, research geologist

U.S. Geological Survey

But the Chinese have been less competent in developing reserves of unconventional natural gas, specifically coal bed methane and deep shale gas. Technology challenges and water scarcity have been barriers to bringing gas to market, despite a national push to explore every possible source and boost the production and use of natural gas.

For instance, local officials resist unlocking shale gas — large supplies may exist in northern, southwestern,and western China — unless hydraulic fracturing (fracking) technology can be improved. As it stands now, each well uses approximately 11,000 to 19,000 cubic meters (3 million to 5 million gallons) of water per frack.

The process of tapping deep seabed methane hydrate by depressurization, meanwhile, does not involve water use at all. On the contrary, it produces water with no salts, which some models suggest could be an important commodity — either for energy production or human consumption, depending on quantities produced — according to Tim Collett, a research geologist at the United States Geological Survey (USGS) who studies gas hydrates. However, the technology for extracting commercial quantities of gas at reasonable costs is far from being perfected, especially because dissociated, depressurized methane hydrates tend to reform if temperatures drop and pressures increase.

“Methane hydrate technology is still a new technology. We’ve only tested it for a short period of time. But suppose that Japan does make it commercial in five years: then 15 years will be feasible for methane hydrate [development] in China.”

–George Hirasaki, professor

Rice University, Houston, TX

“We don’t have a good handle on production rates, and production rates are directly tied to the amount of produced water,” Collett told Circle of Blue, noting that the longest hydrate production tests last only 10 to 20 days, whereas production data for other unconventional fuels has generally taken over a year. “Hydrates are primarily a research topic right now, but an interesting one.”

The Wall Street Journal reported that the estimated cost of tapping methane hydrate ranges from $US 1,059 to $US 2,100 per 1,000 cubic meters ($US 30 to $US 60 per 1,000 cubic feet), which is 10 to 20 times as high as natural gas produced from deep shales in the United States and double to quadruple the imported liquid natural gas (LNG) market price in China during July.

What Is Affordable?

George Hirasaki, a professor and methane hydrate researcher at Rice University in Houston, Texas, told Circle of Blue that, for the time being, importing shale gas will be more economical for China than domestic production of gas via extraction from methane hydrate. He added, though, that import prices for shale gas could rise for China as demand outpaces production, making methane hydrate extraction more price competitive in the near future.

In the case of Japan, an ambitious timetable calls for commercial methane hydrate production within five years. If Japan succeeds, the tools and practices for meeting that goal would be available globally — meaning that other countries could learn quickly, according to Hirasaki.

“Methane hydrate technology is still a new technology. We’ve only tested it for a short period of time,” Hirasaki said. “But suppose that Japan does make it commercial in five years: then 15 years will be feasible for methane hydrate [development] in China.”

In the meantime, China’s search for methane hydrates is not limited to the ocean floors.

Chinese state media reported that Shenhua Group — the largest coal-producing company in China — has begun to move to the Qinghai-Tibetan permafrost area to conduct experimental drilling for methane hydrate. Some reports say that the amount of hydrate in the permafrost could sustain China’s energy use for 90 years. Additionally, several other Chinese drilling technology companies have also expressed interest in the region. All are hoping to deliver the technology that will make methane hydrate extraction more economically feasible.

Linyi Zhang, who recently graduated from Northwestern University’s Medill School of Journalism with a Master’s degree, is reporting this summer from Circle of Blue’s news desk in Traverse City, Michigan. Brett Walton, Circle of Blue’s Seattle-based writer, contributed reporting.

Circle of Blue provides relevant, reliable, and actionable on-the-ground information about the world’s resource crises.

Great article. It seems this will take a long time to develop. It is a technology marathon but the victor will go all the spoils.