Uncertain Future for Shale Gas in Europe — Accepted by U.K., Rejected by France, Others Undecided

Despite getting a go-ahead in the U.K., shale gas faces an uncertain future in Europe.

By Nadya Ivanova

By Nadya Ivanova

Circle of Blue

Nation by nation, the world is taking a close look at the extensive risks and potentially big economic benefits from developing the planet’s huge reserves of natural gas that lie in layers of shale, miles deep. The latest country to back unconventional gas development is the United Kingdom, which last week rejected a moratorium on shale gas prospecting in a parliamentary committee report that looked at the impact of the technique on water supplies, energy security, and greenhouse gas emissions.

The study by the Energy and Climate Change Committee at the U.K. Parliament concludes that hydraulic fracturing—the process of injecting water, chemicals, and sand at high pressure into rock formations to free up the oil and natural gas trapped inside—does not pose a direct risk to underground water aquifers, provided the drilling well is constructed properly. But the committee also acknowledges that while exploiting the shale gas reserves could reduce U.K. reliance on energy imports, it could also divert investment away from renewable technologies like solar, wind, wave or tidal power.

“There has been a lot of hot air recently about the dangers of shale gas drilling, but our inquiry found no evidence to support the main concern—that U.K. water supplies would be put at risk,” Tim Yeo, chair of the committee, said in a press release. “There appears to be nothing inherently dangerous about the process of ‘fracking’ itself, and as long as the integrity of the well is maintained, shale gas extraction should be safe.”

The go-ahead for hydraulic fracturing, long used in the United States but frowned upon by environmental groups, came just two weeks after the lower house of the French Parliament approved a ban on the practice and revoked existing shale gas permits due to environmental concerns. The bill will be considered by France’s Senate in June.

Earlier this year, the French government set a moratorium on unconventional gas drilling, pending commissioned reports due in June to establish its environmental and economic impact.

The British Geological Survey estimates that onshore shale gas resources in the U.K. could amount to 150 billion cubic meters (5.3 trillion cubic feet)—equivalent to about 1.5 years of national gas consumption and seen as a potentially valuable domestic source of energy. More recent figures from the U.S. Energy Information Administration (EIA) estimate that the U.K. has 560 billion cubic meters (20 trillion cubic feet) of technically recoverable shale gas resources.

To date, only one company—Cuadrilla Resources Holdings Limited—has started to frack in England as it explores the shale gas reserves at its Preece Hall site in Blackpool in the northwestern part of the country.

“At this point in time, we have decided that this particular exploratory operation does not require an environmental permit because of the absence of vulnerable groundwaters,” Scarlett Elworthy of the Environment Agency, the environmental regulator for England and Wales, wrote in an e-mail to Circle of Blue. “However, should Cuadrilla want to step up their operation, then we have made it clear that we will need to reassess the situation.”

Uncertain Future in Europe

The United Kingdom and France are among an increasing number of European countries reckoning with the prospects of developing unconventional fuels to diversify their energy sources, reduce their carbon emissions, and wean their dependence on imported gas and oil. But as the European Union prepares to produce 20 percent of its energy from renewables by 2020, there are growing concerns that the branding of shale gas as a low-carbon alternative to coal might hurt the renewable energy industry.

— Tim Yeo,

Energy & Climate Change

U.K. Parliament

“Shale gas could encourage more countries to switch from coal to gas, which in some cases could halve power station emissions,” Yeo said. “But if it has a downward effect on gas prices, it could divert much needed investment away from lower carbon technologies like solar, wind, wave or tidal power.”

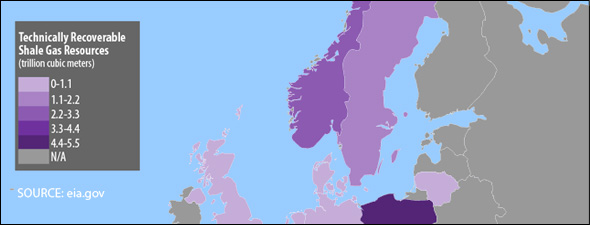

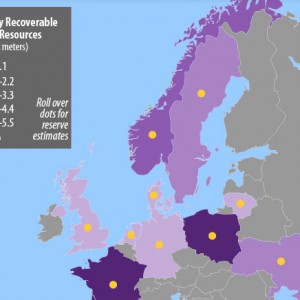

An April report by the EIA estimated the technically recoverable shale gas resources in Europe at about 18 trillion cubic meters (639 trillion cubic feet), compared with 24.4 trillion cubic meters (862 trillion cubic feet) in the U.S. and 36.1 trillion cubic meters (1,275 trillion cubic feet) in China.

Meanwhile, concessions for shale gas test drilling have been given in the Netherlands, Germany, Sweden, Switzerland, France, the United Kingdom, Ukraine, Hungary, and upcoming EU presidency-holder Poland—which the EIA has estimated to have 5.3 trillion cubic meters (187 trillion cubic feet) of technically recoverable shale gas resources, the biggest in Europe.

Poland, which is looking to wean its dependence on domestic coal and gas imports from Russia, and to make shale gas a priority under its EU presidency, has so far granted 86 shale gas exploration concessions (see the map) to about 25 companies, Jacek Henryk Jezierski, Poland’s deputy environment minister, said at a conference in May.

Just how big of a role unconventional fuels will play in Europe is still unclear, experts say. Shale gas production has revolutionized the U.S. energy market, helping the country to turn from a net importer to self-sufficiency and overtaking Russia as the biggest gas producer. Fracking in the U.S. has also sparked significant environmental concerns, however, and is currently under review by the U.S. Environmental Protection Agency.

Although the shale gas resources in the U.K could be considerable—particularly offshore—they are “unlikely to be a ‘game changer’ to the same extent as they have been in the U.S., where the shale gas revolution has led to a reduction in natural gas prices,” according to the parliamentary committee report.

“In contrast to the U.S., Europe lacks any detailed and reliable geological study, making it difficult to estimate the potential for unconventional gas.”

A recent report by the European Centre for Energy and Resource Security (EUCERS) said that unconventional gas development in the whole of Europe has the potential to reshape the continent’s supply, reducing imports from Russia, Central Asia, and the Middle East, but is unlikely to parallel the hydrocarbon boom that is ongoing in the United States.

“In contrast to the U.S., Europe lacks any detailed and reliable geological study, making it difficult to estimate the potential for unconventional gas,” the study says. “Additionally, unit supply costs, environmental regulation, pricing mechanisms, and market structures in Europe are different from those in North America.”

The report, which analyzes the economic and geopolitical role of shale gas on the continent, forecasts that Europe’s fledgling shale gas development is unlikely to become commercially viable until at least 2020.

The industry faces a number of challenges on the continent, particularly meeting the EU environmental standards, adapting to high production costs, and addressing public concerns in Europe, which is much more densely populated than the U.S.

Weighing the Pros and Cons

As Circle of Blue has been reporting since July 2010, hydraulic fracking uses millions of liters of water per well and might pose pollution risk to underground aquifers, as well as the air. Conversely, however, energy industry executives and policy makers in a number of U.S. states say that natural gas burns cleaner than coal and oil, yielding half the carbon emissions of these competing fossil fuels.

In 2010, Pennsylvania enforced a three-year moratorium on further leasing of exploration land until a comprehensive environmental impact assessment has been carried out, and New York state imposed a temporary ban on new shale gas activity.

In other parts of the world, South Africa said in May that it would conduct a feasibility study of hydraulic fracking before it decides on the shale gas applications in its semi-desert Karoo region. Meanwhile, China is taking its first steps in shale gas exploration in Sichuan Province.

“Europe already has regulatory schemes at place, so companies will have to be very careful to comply with them,” Maximilian Kuhn, co-author of the EUCERS report, told Circle of Blue.

The allocation of property rights is also a challenge. Unlike the U.S., where the owner of the land also owns the subsoil and receives revenues from the resources in it, in most of Europe, the state owns the subsoil rights and receives royalties, which gives the land owner fewer incentives to sell the land to drilling companies.

The use of large volumes of water to unlock shale gas from rock formations could also cause competition with agriculture, although recycling technologies could reduce the water use by up to 70 percent, according to the EUCERS study.

Whether or not shale gas becomes affordable and sustainable for Europe soon, unconventional fuel development globally is already changing the European market and challenging traditional suppliers like Russia, the report adds. European nations are increasingly importing liquefied natural gas from Qatar and Australia, and global markets could now rely on the deferred gas supplies in the United States. These practices, as well as Europe’s 2020 renewable energy targets—which are reducing demand for fossil fuels—are already putting downward pressure on market prices for conventional gas on the continent.

“We might not need such a boom as in the United States,” Kuhn said. “Europe needs to assess the resource first. Even then, it’s questionable if it needs to develop the resource to the same extent because it has already changed the leverage in energy negotiations.”

Nadya Ivanova—who has reported from China, Europe, and the United States—is a Chicago-based reporter and producer for Circle of Blue. Reach her at circleofblue.org/contact. Infographic by Kelly Shea and Mark Townsend, recent graduates of Ball State University’s journalism graphics program. Shea and Townsend are Traverse City-based designers for Circle of Blue and can be reached at circleofblue.org/contact.

, a Bulgaria native, is a Chicago-based reporter for Circle of Blue. She co-writes The Stream, a daily digest of international water news trends.

Interests: Europe, China, Environmental Policy, International Security.

Leave a Reply

Want to join the discussion?Feel free to contribute!