Water Scarcity Could Deter Energy Developers From Crossing Border Into Northern Mexico

Before world oil prices collapsed late last year, shop owners closest to the banks of the Rio Grande River in Piedras Negras joked that they could hear the groans of Texas drilling rigs advancing toward their fast-growing northern Mexico city.

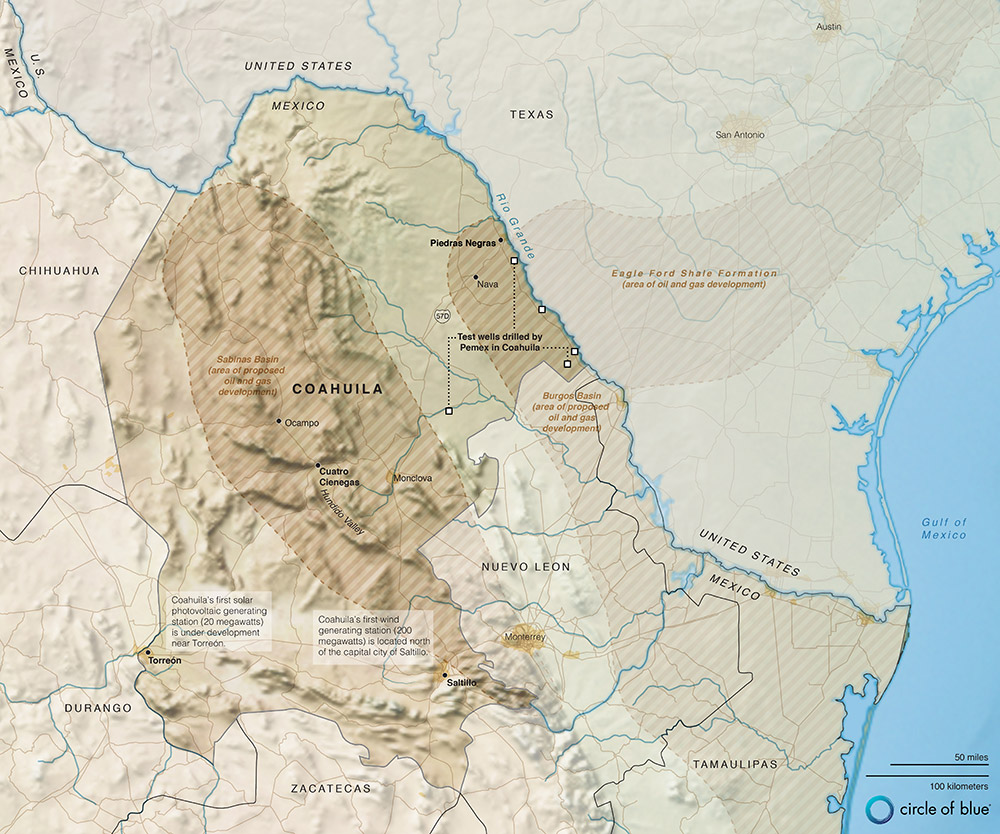

Just seven years ago, the first well was drilled into the Eagle Ford shale formation, which is 80 kilometers (50 miles) wide and stretches northeast for 640 kilometers (400 miles) from the border, past the eastern outskirts of San Antonio. That well yielded such prodigious quantities of gas and oil it set off a frenzy of investment so intense in Texas that 11,000 more wells were completed in the 29-county drilling zone. The Eagle Ford now produces over 1.6 million barrels of oil and 7 billion cubic feet of natural gas daily, according to the U.S. Energy Information Administration, making it one of the largest oil and gas fields on the planet.

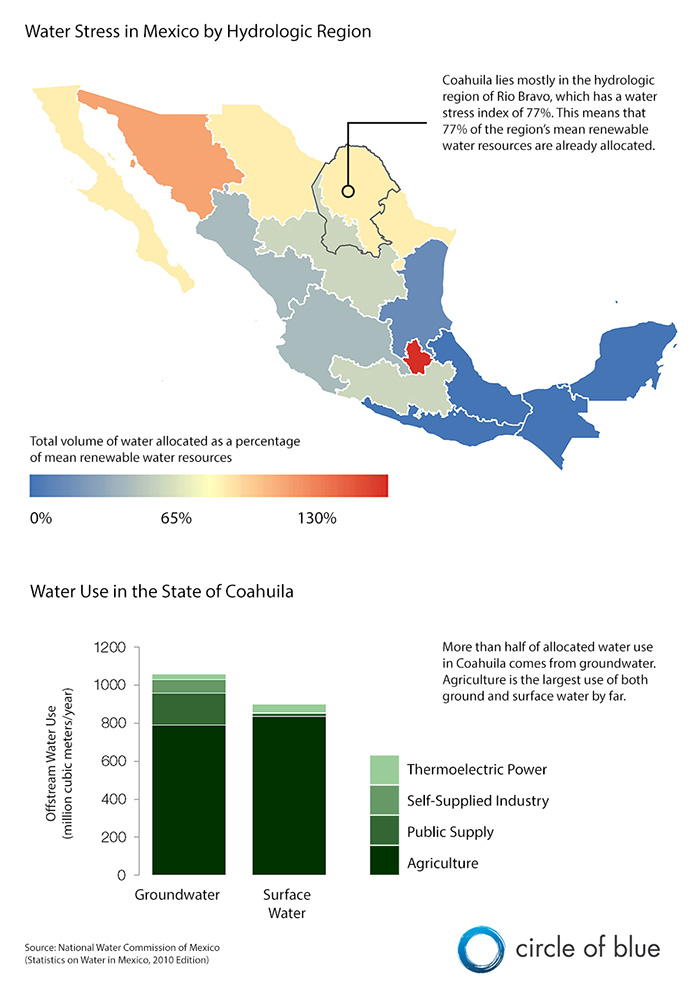

Coahuila is one of the direst regions in the Americas. Most of its available water is supplied from aquifers. Fresh water is so scarce in Coahuila that the Mexico government has already announced that it will not issue new groundwater use permits for oil and gas development. Graphic © Kaye LaFond / Circle of Blue

Until oil prices melted, nothing slowed the development. Not the availability of capital or drilling rigs. Not a deep Texas drought that focused public attention on the 15,000 to 19,000 cubic meters (4 million to 5 million gallons) of fresh water required to drill and hydraulically fracture each well. Not the nearly equal levels of public concern about the billions of gallons of oilfield wastewater and the choices energy development companies were making to pump the toxic liquids into deep disposal wells, some of which University of Texas at Austin researchers linked to heightened earthquake activity.

A northern Mexico state bordering the Rio Grande River, Coahuila’s desert terrain is the focus of expansive and risky water-consuming oil and natural gas development. © 2015 Circle of Blue. All Rights Reserved. Produced by Erin Aigner for Circle of Blue

The big questions asked by northern Mexico state and business leaders are two-fold. First is whether the portions of Eagle Ford shale that reach under the Rio Grande and deep into Coahuila are capable of producing anywhere near the same quantities of fossil energy. Another question is whether difficult ecological conditions, particularly the scant reserves of fresh water in Mexico’s second driest state, are suitable to support intense drilling and development.

A Confrontation in Approaches

Such issues anchor the momentous and era-changing choices that the desert Mexican state of nearly 3 million residents faces. In large measure, shale oil and gas drilling is a 20th-century construct, a readily recognizable strategy to mass potentially enormous energy resources, intensive industrial infrastructure, and huge sums of financial capital to achieve heightened economic development. In short, drilling a lot of oil and gas wells, and building a transport and processing infrastructure, is a familiar formula for growth.

But is the plan for mammoth oil and gas development potentially reckless? How much of what is envisioned in Coahuila is really possible in the challenging demographic, resource-scarce, and drying conditions of the 21st century? In other words, Coahuila closely resembles southern Mongolia, northern China, the American West, Australia, and southern Africa, where growing cities, agriculture, and energy development fiercely compete for resources, especially diminishing supplies of fresh water.

The source of the water deficit in Cuatro Ciénegas is groundwater irrigation from grain farms in Ocampo, about 50 kilometers (31 miles) north of Cuatro Ciénegas, and from alfalfa and dairy production in the south Hundido Valley, about 45 kilometers (28 miles) southwest. Here, a center-pivot sprinkler irrigates Hundido Valley fields. Photo © Janet Jarman / Circle of Blue.

The confrontation is so fraught with ecological urgency and climatic change that decades of entrenched regional economic policy and resource practices are shifting. Australia rewrote its water use statutes and spent billions of dollars to rebuild its irrigation network in the Murray-Darling Basin following a vicious 12-year drought. China shifted its major grain-producing region to the wet northeast and launched the world’s largest solar and wind energy sector to reduce water use in the drying Yellow River Basin. In the United States, a four-year drought prompted California to issue the first mandatory water restrictions in its history. The state also is much more closely overseeing water use and wastewater disposal in its oil industry, the nation’s third largest.

For the time being, the mega-energy-development paradigm prevails in Coahuila. Sometime later this year, or early in 2016, oil and gas companies could provide more insight into what they think is possible in the desert when Mexico opens bidding for oil and gas development rights to foreign companies. The new market is due to a change in Mexico’s Constitution in 2013, and new regulations in 2014, that made foreign investment possible in the country’s oil and gas sector.

Coahuila Says It Is Ready

Whether the shale gas fields of Coahuila and its neighboring states are included in the offering, though, is not certain. The national government has expressed concern about low gas and oil prices, and about security. Northern Mexico is the base of operations of “Los Zetas,” the most technologically advanced, sophisticated, and dangerous Mexican gang, which has infiltrated the state’s coal sector and terrorized several energy-exploration teams.

The governor of Coahuila, Rubén Moreira Valdéz, among the industry’s biggest boosters, is not intimidated. Moreira is pressing the national government to open bidding for development rights in his state to keep a promising oil industry job boom going. Earlier this year, during a shale development conference in Mexico City, Moreira told attendees that “the economic development of shale oil and gas, and related investments, has generated more than 800 shale gas and shale oil jobs” in Coahuila.

The Duñas de Yeso are unique in Mexico and are often compared to the White Sands National Monument in New Mexico. The dunes were formed over thousands of years by sand grains, moved by the wind from deposits left on the banks of the Laguna Churince. Water on the lake has disappeared in the past few years. Conservationists fear that this process has now been interrupted, with unpredictable consequences for the dunes and its unique ecology. Photo © Janet Jarman / Circle of Blue.

Executives of Pemex, Mexico’s national oil company, join administrators in Mexico’s Ministry of Energy in projecting much larger returns. Two years ago, the U.S. Energy Information Administration estimated that northern Mexico reserves held 13 billion barrels of shale oil and 600 trillion cubic feet of natural gas, ranking the region as one of most potentially productive shale energy zones on the planet.

Pemex anticipates that the oil- and gas-producing basins of Coahuila and neighboring Nuevo Leon could attract over $US 100 billion in investment to drill 8,000 to 10,000 oil and gas wells. Coahuila state authorities added that they expected $US 64 billion of that total to be invested in their state, and that 240,000 jobs would result. Earlier this year, a report by the University of Texas at San Antonio, Universidad Autonoma de Nuevo Leon, Asociacion de Empresarios Mexicanos, and the Wilson Center’s Mexico Institute was similarly enthusiastic. The report asserted that Mexico is in an ideal situation to reap the benefits of unconventional extraction techniques.

High Water Consumption

Maybe. Not nearly enough of Coahuila’s planning for energy development has included the industry’s demand for water. Conservation technology and new drilling practices have reduced water use in the Texas Eagle Ford region. Texas state authorities report that fracking is responsible for 2 percent of total state water use. It still requires, however, enormous quantities of water to develop shale oil and gas. A study by the University of Texas in 2011 found that water demand for fracking in the most heavily drilled Eagle Ford counties amounts to 30 to 50 percent of all water use in those counties.

A newer study by Texas A&M University last year reported that hydraulic fracturing in the Eagle Ford used 620 million cubic meters (164 billion gallons) of groundwater annually. Aquifers in the region were being drawn down at a rate 2.5 times faster than their recharge rates.

Alfonso Gonzalez is a cattle farmer who actively participates in conservation initiatives around Cuatro Ciénegas. In one effort, a pond on his property was restored to its original state, leading the area around it to regenerate humidity and lush flora and fauna. Photo © Janet Jarman / Circle of Blue.

If developers used the same amount of water for fracking a comparable number of wells in northern Mexico as they do in Texas, that amounts to nearly one-third of the 1.96 billion cubic meters (517 trillion gallons) of water currently used each year for all purposes in Coahuila, according to Conagua, the national water commission.

At least one measure of the economic and ecological distress over water that could await Coahuila is already evident in the 350 kilometers (217 miles) of desert between Piedras Negras and Cuatro Ciénegas, a small city of 12,000 residents that was once the hub of a lush oasis of spring-fed pools and marshes.

In December 2013, after 75 years of operating as a closed and monopolistic state-run sector, Mexico´s oil and gas industry was opened to foreign and private investment by the passing of a constitutional reform in the national Congress. The changes, carried through into secondary legislation in August 2014, mean that private and foreign firms are now permitted to invest in all aspects of the hydrocarbons value chain and that a new legal and regulatory framework, based on international best practice, governs the sector. Most of the international interest has focused on the potential reserves in the shallow and deep waters of the Gulf of Mexico. However, there is a nucleus of national and foreign companies that have expressed interest in exploiting Mexico´s unconventional resources, primarily in the extension of the Eagle Ford formation that crosses the U.S.-Mexico border.

Piedras Negras and Coahuila’s other cities use 186 million cubic meters (49.1 billion gallons) of water annually, most of it drawn from aquifers, according to Conagua.

On the outskirts of Piedra Negras, along Federal Highway 57D, lies a portion of the state’s big manufacturing plants for vehicles and steel. Not far away are the mines that produce 13 million metric tons of coal a year, almost all of the coal produced in Mexico. Much of it is consumed by the two big coal-fired power plants in Nava. Ninety percent of Coahuila’s electricity comes from coal-powered plants; 98 percent from all fossil fuels. The result is that electricity generation uses 75 million cubic meters (19.8 billion gallons) of water annually, a little more than the 73 million cubic meters needed for industry, according to Conagua.

South of Nava is a farming region. Agriculture is the largest water consumer in Coahuila, using 1.62 billion cubic meters (428 trillion gallons) annually, or 82 percent of the state’s annual water demand.

Most of the trip between Piedras Negras and Cuatro Ciénegas, though, is swallowed by Chihuahuan Desert that encompasses the Burgos and Sabinas basins, the regions targeted for oil and gas development. Pemex has drilled six test wells in the two basins. Production results suggest that the shale is capable of producing marketable quantities of gas and oil.

A Desert Oasis That Is Drying

There is virtually no surface water available in this part of the Chihuahuan Desert, an expanse of thin pads of grama grass and stands of creosote bushes and mesquite. Coahuila receives little more than 300 millimeters (12 inches) of rain annually, according to Conagua. It is the second driest place in Mexico and ranks with Egypt and the Arabian Gulf as among the driest places on the planet.

That is what makes the running streams and desert marshes of Cuatro Ciénegas, a half day’s drive south of Piedras Negras, so rare and such a valuable reference for the ecological disruption and economic dislocation that can occur with mistakes in water supply and use. Until three decades ago, the 215-year-old farming community was a farm and business hub set amid a thriving oasis where vineyards and orchards of peaches, pomegranates, and walnuts were irrigated with water drawn from clear, spring-fed streams and pools.

In one conservation effort near Cuatro Ciénegas, a pool was restored, leading to the recovery of riparian vegetation. Despite management oversight since the mid-1990s by Mexico’s national parks agency and designation as an international biosphere reserve, Cuatro Ciénegas is steadily drying up. Photo © Janet Jarman / Circle of Blue.

Outside town, thick stands of marsh grasses grew as tall as a man. In the 1960s, Mexican and American biologists and ecologists began to swarm across the 150,000 hectares (370,000 acres) of desert pools and wetlands, discovering a biological treasure of plants and animals so abundant and distinctive they likened Cuatro Ciénegas to the Galapagos Islands.

Strong daily winds churn grasses in the afternoon as sunset approaches near Cuatro Ciénegas. Photo © Janet Jarman / Circle of Blue.

Today, despite management oversight since the mid-1990s by Mexico’s national parks agency and designation as an international biosphere reserve, Cuatro Ciénegas is steadily drying up. Vinos Vitali, a winemaker and lifelong resident, told a University of Texas video team, “There used to be a lot of water here and a lot of fruit. Now there’s no water and nothing is left.”

Alfonso Gonzalez, a rancher in town, added, “You’re seeing a crisis now because the water has not been sustainably managed.”

Competition For Water Leads To Deficit

The source of the water deficit in Cuatro Ciénegas, according to researchers from the University of Texas at Austin, is groundwater irrigation from grain farms in Ocampo, about 50 kilometers (31 miles) north, and from alfalfa and dairy production in the south Hundido Valley, about 45 kilometers (28 miles) southwest.

Water scarcity is one of the issues prompting Coahuila state authorities to encourage electrical generation from renewable resources. A recent report by the Wilson Center’s Mexico Institute and Green Momentum found that, despite the dominance of fossil fuel-powered generation in Coahuila, the state has the potential to dramatically increase wind and solar installed capacity by 2020. A 20-megawatt solar photovoltaic generating station, the state’s first, is under development near Torreon, in western Coahuila. EDP Renovaveis S.A., a Spanish renewable energy company, is developing a 200-megawatt wind power station near Saltillo, the state capital.

Both farm areas lie at elevations above Cuatro Ciénegas, explained Brad Wolaver, a research associate with the University of Texas Jackson School of Geosciences. Farmers irrigate with wells drilled into aquifers recharged from rainfall from nearby mountains. But those same higher-ground aquifers also are connected to the network of springs that supply Cuatros Ciénegas, which are on the valley floor.

So much water is being pumped in the two farm regions to irrigate crops and care for livestock that not early enough is left to supply the pools and marshes. With every passing year, the desert claims more land, more ponds, more streams that used to be wet.

“One major stream that flowed from the Ocampo-Calaveras Valley to the north ceased flow,” Wolaver said. “There are dozens of springs that still flow but, in the long term, may see reduced flows if heavy groundwater pumping continues in the surrounding valleys.

“What’s happening is a lesson in what occurs when a finite supply of water needed by everyone is used without enough concern about limits,” Wolaver added in an interview.

It is entirely possible — maybe even probable without a clear and enforceable plan for water use — that the same circumstance could occur on a much larger scale in cities and farm areas that reside in close proximity to Coahuila’s oil and gas fields.

Until three decades ago, the 215-year-old farming community of Cuatro Ciénegas was a farm and business hub set amid a thriving oasis where vineyards and orchards of peaches, pomegranates, and walnuts were irrigated with water drawn from clear, spring-fed streams and pools. Photo © Janet Jarman / Circle of Blue.

“Water supply is an urgent concern throughout that entire region,” said Mark Briggs, a restoration ecologist with the World Wildlife Fund, based in Tucson. “Populations are growing on both sides of the Rio Grande. Water supplies in the Rio Grande Basin are over-allocated. Cities are reaching across groundwater basins to supply themselves with water. Climate change is a factor in intensifying drought cycles. Add major energy development and its water needs. You have to wonder where all this is going.”

To some extent, water supply is part of the government discussion about energy development in Coahuila. Conagua authorities last year declared that new permits for the state’s 28 existing aquifers would not be available for developers of shale oil and gas wells. Nor is water available for fracking from the Rio Grande River, which is over-allocated and regulated by various transboundary commissions.

A Ban on Groundwater Use for New Energy

According to Carlos Gutiérrez Ojeda, head of the groundwater division of the Mexican Institute of Water Technology, that leaves energy development companies with several other options for securing adequate supplies of water for fracking.

The first and easiest, Ojeda said in an interview, is for energy developers to buy existing groundwater use permits from farmers, industry, or other users.

Other options, he said, include:

- Discovering and tapping new aquifers that lie deeper than known groundwater reserves. The deeper groundwater sources, if they exist at all, are likely to contain high levels of salt and minerals that will need to be treated. National water authorities are likely to issue permits to tap those brackish groundwater supplies, which are not currently used by cities, farms, or industry.

- Recycling and treating wastewater from municipal and industrial treatment plants. That potential supply, though, is at least 80 percent less than what the energy industry is likely to need. An important consequence of using treated municipal wastewater is that this water supply is now discharged to streams and rivers. Thus, capturing this water could have the effect of reducing flows to streams, which could harm aquatic ecosystems and downstream water users.

- Pumping water from the Gulf of Mexico and transporting it hundreds of kilometers in new pipelines to the drilling zones. Seawater is too salty for fracking using current technology. Some desalination capacity would need to be constructed near the sea or at the other end of the pipe, close to the drilling zones.

Summed up, if Mexico enforces its proposed ban on issuing permits to drillers for existing groundwater sources, the industry’s water demand can only be met by uncertain and expensive supplies.

“There are big questions that need to be answered,” Ojeda said. “We are looking closely at what could happen. Conagua says no groundwater will be used for fracking. Water must come from some other source. That’s what the authorities said.”

The Lago de las Monjas dried out a few decades ago. The state of Coahuila receives little more than 300 millimeters (12 inches) of rain annually. So much water is being pumped in two farm regions near Cuatro Ciénegas to irrigate crops and care for livestock that not early enough is left to supply the pools and marshes. With every passing year, the desert claims more land, more ponds, and more streams that used to be wet. Photo © Janet Jarman / Circle of Blue.

Among industry executives and government authorities charged with promoting job growth, the scale of what is possible with shale development in Coahuila — and the potential treasure chest that it could open — overwhelms other considerations, for understandable reasons.

Industry Still Exuberant

American energy companies spent an average of $US 15 billion a year to develop the Eagle Ford shale since 2008, more than $US 80 billion in total. Mexican authorities think it will take at least $US 100 billion to develop Coahuila’s shale resources.

That figure is well below the $US 662 billion to $US 1.02 trillion in capital spending that Goldman Sachs estimated would be needed to develop Mexico’s shale reserves in an analysis last year.

Some of the difference in cost estimates is the result of the quality of northern Mexico’s shale. Studies in the open geological science literature suggest that the Eagle Ford shale beneath Coahuila differs substantially in structure and carbon composition than the shale beneath Texas. Goldman Sachs researchers also noted in their study that, due to the extensive investment in needed infrastructure, “we would not anticipate any robust development taking place before 2018-2020.”

Norma Alicia Valdez conserves water to care for her home in the center of Cuatro Ciénegas. The town struggles with water shortages related to water extraction for large-scale farming nearby. The Valdez family once farmed 20 hectares (49 acres) of alfalfa. After industrial-scale farms moved in near Ocampo, Valdez said her family no longer could find sufficient water. They now farm five hectares (12 acres). Photo © Janet Jarman/Circle of Blue.

The global oil industry, ever audacious in its quest for hydrocarbons, is driven to tap new reserves where they exist, and never more so than during this century. From the icy depths of the Arctic to the perilous high-tech platforms of the Gulf of Mexico, from the isolation of Siberia to the narrow foothill Himalayan valleys of Sichuan, the global energy industry is exploring and tapping new reserves. It is no surprise that the enthusiasm displayed by the oil and gas industry for northern Mexico’s shale potential is genuine, deep, and characteristically flamboyant.

During a Mexico shale oil and gas summit in San Antonio in February, for instance, business and government authorities rallied around the idea of Coahuila drilling and its role in a U.S.-Mexico-Canada oil and gas alliance capable of competing with OPEC for global leadership in hydrocarbon production.

“The possibility of a North American energy confederation is still something I would like to see on the table – for Canada, Mexico and the United States,” Chris Faulkner told the conference. Faulkner is chief executive of the Dallas-based Breitling Energy Corp. “It doesn’t seem to be on anyone’s radar in Washington, [D.C.] But if we could strive for North American energy independence first, we would be the second largest oil producing coalition in the world next to OPEC, and would be incredibly formidable in determining world oil policy. Mexico is in an excellent position. They know it.”

Coverage of the competition between water, food, and energy in Mexico is produced in collaboration with the Wilson Center’s Mexico Institute.

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider

Leave a Reply

Want to join the discussion?Feel free to contribute!