Financiers Express Concern About Missouri River Pipeline Crossing

Conflict over water supplies and land makes investors nervous

The Dakota Access Pipeline, a 1,200-mile, US$3.7 billion mega oil transport project under construction across the Great Plains, is 70 percent complete. Photo by Lars Plougmann

This story was updated on November 18, to reflect DNB bank leaders announcement that they sold a $US 3 million stake in the pipeline’s builder.

By Keith Schneider

Circle of Blue

Executives of Energy Transfer Partners, builders of the Dakota Access Pipeline, expressed a sigh of relief this week following Donald Trump’s election victory. The president-elect, who campaigned on a platform that promised to remove impediments to fossil fuel development, is an investor in the Texas-based company. The relationship is reciprocal. Kelcy Warren, Energy Transfer’s chief executive and chairman, donated over $US 100,000 to Trump and his campaign.

But completing projects that put water supplies at risk and are as big and expensive as the 1,200-mile, $US 3.8 billion oil pipeline is an orchestration, not a duet. It depends on more than support from an incoming American president and a business executive. What initially seemed to Energy Transfer executives and its lenders to be a safe and profitable way to transport fuel from one of the world’s largest oil fields has instead evolved into an object lesson of the financial risks and social tumult caused by mega-scale development projects in the 21st century.

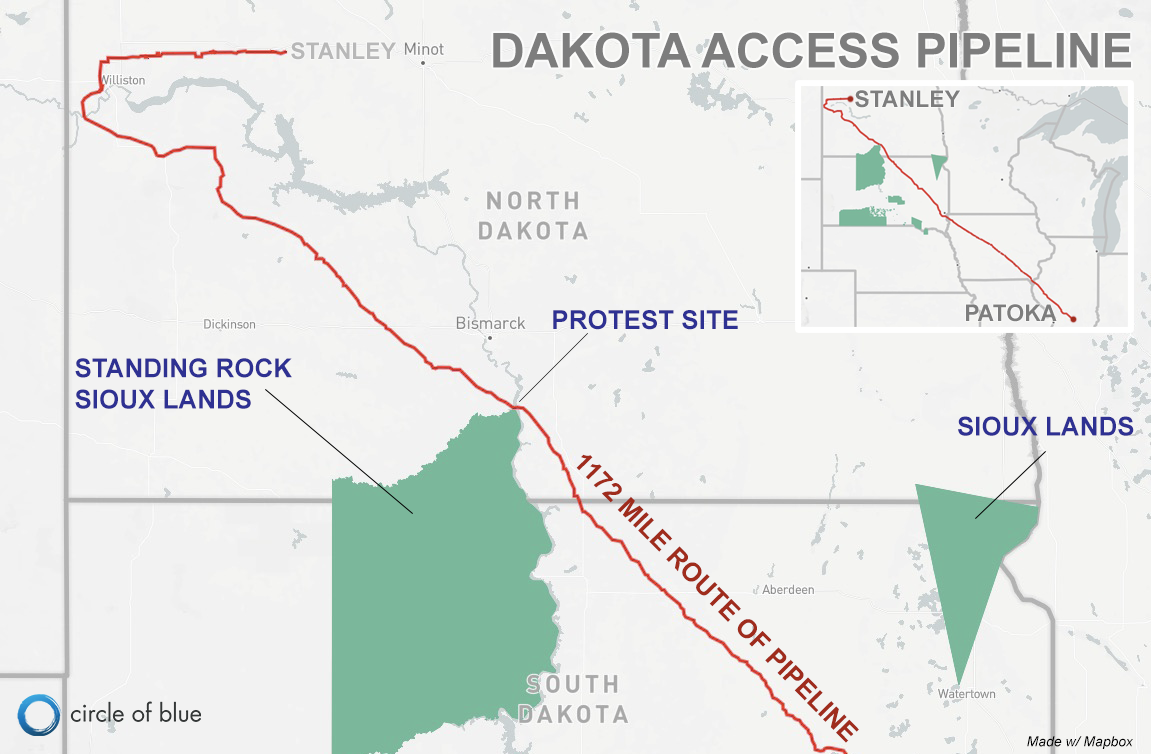

The pipeline route crossing the Great Plains and underneath Lake Oahe, a reservoir on the Missouri River, has activated thousands of protesters concerned about the safety of tribal lands and water supplies. President Obama, in September, responded to the opposition and blocked pipeline construction across federal land closest to the river and to the Standing Rock Sioux tribal lands.

The pipeline’s purpose, to transport oil from North Dakota’s Bakken oil field, one of the world’s largest, to a terminal in Illinois also has been swept up in the global campaign to limit emissions of fossil-fueled carbon to the atmosphere. Energy Transfer says 70 percent of the project is completed.

© Cody Pope/CircleofBlue.org 2016

Investigating the Banks

This week, several non-profit research groups focused their opposition on the financial institutions that are providing loans to Energy Transfer, and landed several blows.

DNB, a Norwegian bank,

said it would reconsider its $US 342.3 million pipeline investment if conflict between the company and the Standing Rock Sioux Tribe is not resolved.

Citigroup Inc., which is managing much of the financing, said in a statement that it “had discussed its concerns” with Energy Transfer and urged the company to reach a resolution with the tribe. The groups, led by BankTrack, a Dutch research organization, criticized Citigroup because it adopted lending guidelines that discourage investments in fossil fuel projects.

DNB, a Norwegian bank, is the first to act. On November 17, bank leaders announced that they sold a $US 3 million stake in the pipeline’s builder. The bank is also reconsidering its $US 342.3 million loan, representing about 10 percent of the project cost, if conflict between the company and the Standing Rock Sioux Tribe is not resolved.

“Our policy is clear that we only finance projects that meet DNB’s requirements with respect to environmental and social conditions,” said Harald Serck-Hanssen, group executive vice president and head of Large Corporates and International for DNB, in a statement. “We have intensified the dialogue with our customers and emphasized that respect for the indigenous people’s rights is an important value for us as a bank. We also urge that the dialogue be continued with the indigenous people to find solutions to the conflict. If our initiative does not provide us with the necessary comfort, DNB will evaluate its further participation in the financing of the project.”

The Standing Rock Sioux Tribe’s campaign to block the Dakota Access Pipeline from crossing the Missouri River has attracted support from across the United States, and around the world. Photograph by, Joe Brusky

Ferocious Fight

The skirmish between protesters and the company has been fierce. Hundreds of people have been arrested in North Dakota. Thousands more flocked to the area to demonstrate. Late last month the United Nations Permanent Forum on Indigenous Issues, a UN advisory group, began investigating allegations of cruel treatment and human rights abuses by North Dakota police and private security officers against protesters. Sioux leaders told investigators they viewed the violence and mass arrests last month as “acts of war.” North Dakota police officials said that they responded with force to prevent “illegal roadblocks and protesters trespassing.”

The newest tool in the opposition campaign against the pipeline is pressure on the project’s lenders. More than a dozen major banks have provided $US 2.5 billion in loans and guarantees to Energy Transfer, according to an investigation by Hugh MacMillan, a senior researcher at Food and Water Watch. Of that amount, $US 1.4 billion is tied up pending federal approval to cross Lake Oahe.

Energy Transfer said on November 8, election day, that it was moving equipment to complete the crossing pending the U.S. decision, which it expected soon. Environmental and bank research groups sympathetic to the tribe’s opposition campaign anticipated that announcement and released a letter on November 7 that shifted attention to the pipeline funders.

Banks Pressured

The letter by 26 groups was sent to Nigel Beck, the chairman of the Equator Principles Association, a group focused on the social and environmental risk of big investments. It urged the financial institutions that support the pipeline and the Equator Principles to halt any more loan payments.

The groups said that risks to water supplies and sacred tribal lands in North Dakota, and threats to the global climate, violated the sustainability goals embraced in the Equator Principles and by the 85 banks that are signatories. Investigators from the environmental and bank groups determined that 13 signatory banks were financing the Dakota pipeline and eight more banks support the project’s creditors.

“Banks have a choice to either finance the transition to renewable energy, or to finance pipelines and power plants that will lock us into fossil fuels for the next 40 years,” Johan Frijns, director of BankTrack, told the New York Times. “If we’re serious about fighting climate change, we can’t continue to finance fossil fuel infrastructure of any kind.”

Energy Transfer executives have not responded publicly to the letter or the disturbance in its financing. Mass protests in cities across the United States on November 15 rallied against the pipeline.

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider