https://www.circleofblue.org/wp-content/uploads/2018/11/2017-01-India-Tamil-Nadu-DMalhotra_C4A7610-2500.jpg

1600

2400

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2018-07-03 15:03:082019-06-24 15:35:12Chennai’s Security Tied to Cleaning Up Its Water

https://www.circleofblue.org/wp-content/uploads/2018/11/2017-01-India-Tamil-Nadu-DMalhotra_C4A7610-2500.jpg

1600

2400

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2018-07-03 15:03:082019-06-24 15:35:12Chennai’s Security Tied to Cleaning Up Its WaterMindful of Water Scarcity, Cost, and Pollution, Tamil Nadu Turns to Sun and Wind Power

A momentous shift to cleaner generating technologies that conserve water.

By Keith Schneider, Circle of Blue – June 14, 2017

MADURAI, India — Before he agreed to serve as minister of state and take command of his country’s mammoth energy production and distribution sector, Piyush Goyal developed one of India’s most spirited political careers. “A man of ideas and competence,” according to First Post, a prominent news organization, Goyal is an accountant and lawyer who rose to the peak of Indian economic and political culture as an investment banker, member of Parliament, and treasurer of the Bharatiya Janata Party, the country’s ruling political party.

Following the May 2014 national election — a BJP triumph — Goyal seemed poised to assume any number of economic development posts in Prime Minister Narendra Modi’s new government. Modi recognized, though, that Goyal’s expertise in law, international finance, and politics was a near perfect fit for one of the most difficult ministerial assignments. Modi asked Goyal to make over India’s obsolete, dangerous, water-wasting electrical generating sector.

India churns with economic disruptions that are not helped at all by frequent blackouts and confrontations over scarce water between citizens and its coal-fired electrical stations. State and national agencies are burdened by corruption that impedes the fair permitting and enforcement of pollution control laws. In villages across India rural people organize to protect their water supplies and block coal mines and the construction of coal-fired power plants.

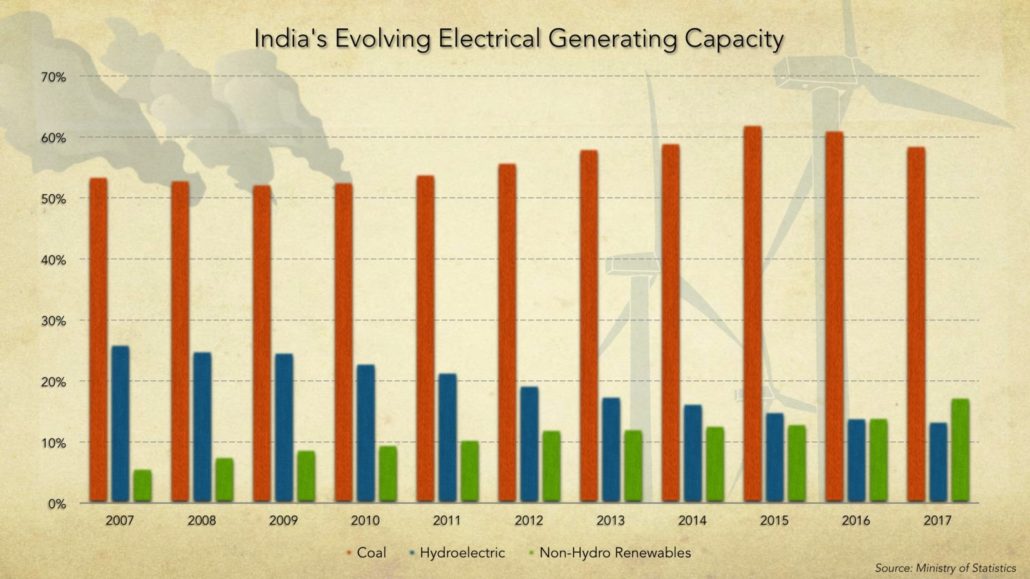

India’s leaders are attempting a delicate maneuver: stoking the fires of economic growth while jettisoning an energy strategy that relies on coal for almost 70 percent of its electricity. Goyal has moved to meet that challenge much faster than anybody anticipated. Though he has not attained the global prominence of Pope Francis, Barack Obama, Al Gore, Bill McKibben, or Elon Musk as a leading champion for curbing climate change, Goyal belongs in the conversation. “We have crossed 10,000 [megawatts] of installed capacity of solar,” Goyal said in one triumphant tweet in mid-March. “In another 15 months we expect this to go up to 20,000 MW & 100,000 MW by 2022.”

India now competes with China, the United States, Japan, and Germany as a world-leading developer of electricity from wind, solar, biomass, and small hydropower plants. India’s generating capacity from wind power is now more than 30 gigawatts, fourth among nations, and nearly 6 gigawatts more than two years ago. India’s solar electrical generating capacity doubled in the last year to 10 gigawatts. A gigawatt is 1,000 megawatts, roughly the size of a large coal or natural gas power station.

Overall, India reached 50 gigawatts of renewable generating capacity in March 2017, excluding large hydro-electricity. That is twice as much as in 2012 and equal to 16 percent of India’s total generating capacity. The country ranks fifth in the world in renewable capacity, according to government figures.

India also is competing with China and the United States in the global competition to shut down old coal-fired plants and curtail development of new ones. In December 2016 India announced an energy plan to develop 275 gigawatts of generating capacity from renewable sources by 2027. That is equal to more than a quarter of all the generating capacity in the United States. The Central Electric Authority said that the goal meant that India would not need to start building another new coal-fired generating station for at least a decade and likely longer. India, in effect, is prepared to shelve 178 gigawatts of planned coal-fired generating capacity.

Goyal followed that disclosure with another – a plan to quickly close at least a dozen still operating end-of-life coal-fired plants that have a total of 11 gigawatts of generating capacity. “That one action alone will not only help us bring in more efficiency in the operation of thermal plants, but will help us reduce millions of tons of carbon dioxide that is being generated by the age-old plants,” he said in a statement. “It will help us reignite economic activity in the power sector.”

The numbers express a profound new reality in India’s energy industry that carries international significance: Climate-changing carbon emissions in India, the world’s third largest producer, are poised to start leveling off after years of sizable increases. India is joining China, the United States, and Europe in reducing carbon emissions at the same time that economic activity increases. In March, the International Energy Agency reported that in 2016, for the third year in a row, climate-changing emissions to the atmosphere did not increase. The leveling-off occurred even as the global economy expanded.

Tamil Nadu’s Water-Conserving Energy Fields

Here in Tamil Nadu, a southeast state along the Bay of Bengal, that reality is distinctively visible across expanding wind and solar energy fields. Tamil Nadu’s various power stations hold 27.3 gigawatts of electrical capacity. Nearly 10 gigawatts of capacity are generated from renewable sources, more than any other Indian state or territory, according to Central Electric Authority figures.

Most of the state’s renewable electricity is generated south of Madurai, a city of magnificent Hindu temples and 1.5 million residents. Along a 20-kilometer stretch (12 miles) of land, thousands of windmills rise above the green canopies of oil palm plantations. One generating farm alone, the 1.5-gigawatt Muppandal wind farm, is the largest in the world outside China.

Northeast of the wind generating zone lies the Adani Group’s 648-megawatt Kamuthi solar photovoltaic plant, the largest in India and one of the largest in the world. The 1,000-hectare installation (2,500 acres) opened last summer on a thinly-settled stretch of sun-scorched desert near Sengappadai. It took 18 months and $US 670 million to plan, design, and build the plant– a quarter of the time it takes to develop and construct a similar-sized thermal power plant, according to Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis, a global research group based in Cleveland, Ohio.

The Adani Group’s foray into solar energy marks a sharp pivot in the company’s energy generation strategy. For decades since its founding in 1988, Adani was intensely involved in developing coal mines and coal-fired power plants in and outside India. The company has attracted global attention for its $US 16 billion multi-stage 60 million tonne per annum proposal to build the low grade Carmichael thermal coal mine in Australia, which has generated fierce opposition from environmentalists and economists. But in India, Adani is gating back its domestic fossil fuel goals in favor of renewables. The company now proposes to build big solar plants in 11 Indian states that would hold 10 gigawatts of electrical capacity, or 10 percent of the country’s 2022 solar generating goal.

A Wind and Solar Corridor

Powering Tamil Nadu’s growing renewable electrical industry is a host of favorable conditions. By far the most important is the state’s fortuitous position between the Bay of Bengal to the east and the Western and Eastern Ghats mountain ranges to the west. The warm ocean and the tall mountains provides more than 300 days of ample bright sunlight a year and strong steady winds at night for the state’s solar and wind energy corridor.

“It’s a perfect combination for renewable sources,” said Hans Raj Verma, Tamil Nadu’s principal secretary for rural development, in an interview. “Sun by day. Wind at night. The fuel source is free 24 hours a day.”

Other advantages are state and central government financial incentives for clean energy that encouraged construction of Tamil Nadu’s first wind installations a decade ago. Since then Goyal has designed new debt financing instruments, power purchase agreements, and recruited international capital to begin accumulating the estimated $US 250 billion that India will need to reach its national grid upgrade and renewable energy goal of 175 gigawatts by 2022.

Hans Verma is optimistic that Tamil Nadu will attract a significant share of the investment. The cost of building new wind and solar is dropping below the cost of constructing new fossil fuel plants, in part because they take much less time to complete. And because they use scant water, do not pollute, and are constructed away from the coast and in less densely populated regions of Tamil Nadu, renewable projects encounter much less public resistance.

“Producing electricity that we need without so many negative effects makes renewable energy an attractive option,” said Verma. “At this point in our development it makes very good sense.”

Other meteorological and civic trends, meanwhile, are interfering with the operations of Tamil Nadu’s thermal energy suppliers. The state’s nuclear sector includes two coastal plants, both cooled by sea water, that have 2,440 megawatts of electrical capacity.

The long delayed 2,000-megawatt Russian-built Kudankulam station, the largest and newest nuclear plant in India, opened its first 1,000-megawatt generating unit last year. A second is due to start commercial operation this year. The plant has a troubled operating history of frequent unplanned shutdowns and a legacy of fierce public protests. Opponents argue that the risk of a serious accident is too high and that heated water released to the ocean from the plant’s cooling system is damaging fisheries.

As recently as 2010, Indian authorities expressed big ambitions for the country’s nuclear power sector. Generating capacity would increase to over 80 gigawatts over the next two decades, up from less than 6 gigawatts. That aggressive plan has been considerably tamed since the nuclear accident at Fukushima in 2011. Nuclear plants also are notoriously difficult to finish on time and often billions of dollars over budget.

India no longer mentions that 80-gigawatt nuclear goal. Minister Goyal confirmed India’s shift in nuclear policy during an India economic summit in 2014. “This government would like to be cautious so that we are not saddled with something only under the garb of clean energy or alternate energy,” he said. Getting international financing for nuclear projects is most likely an unstated but insurmountable obstacle, given the financial risks involved.

Stranded Fossil Fuel Assets

In Tamil Nadu’s fossil fuel sector, operating conditions are no better. The deep drought of the last two years has made cooling water scarce and curbed production at coal-fired power plants. In late February low water levels in the Thamirabarani River forced the 1,050-megawatt Tuticorin Thermal Power Station to indefinitely shut down.

Up the coast in Petthankuppam, Il&FS planned to build a 3,180-megawatt coal-fired power plant. The energy finance and development company succeeded in opening two 600-megawatt generating units in 2015 and 2016. Three other larger units were stopped by a court order in a case brought by fishermen and residents. Opponents argued that the plant would damage fishing grounds and other natural assets, and that construction permit applications were incomplete.

Just north of the Il&FS power station lies the shuttered $US 2 billion Nagarjuna oil refinery. The facility, constructed along a Bay of Bengal beach, was blasted by a cyclone in 2011. Its owners decided not to make extensive repairs, and a new buyer has never come forward. The closed refinery, its unmaintained machinery accumulating rust and mold, is one of the most expensive examples of a fossil fuel stranded asset on the planet.

And in Vilambur, 80 kilometers (50 miles) north of the refinery, lies the site of the Cheyyur Ultra Mega Power Project, a proposed 4,000-megawatt import coal-fired power plant that failed to attract a developer and is all but formally declared dead.

Just five years ago India and Tamil Nadu still proposed to build over two dozen coal-fired plants with well over 20 gigawatts of new generating capacity.

Almost every project has been shelved.

New Operating Plan

In effect, Goyal and Modi are tossing aside India’s old energy plan and installing a new one that the prime minister calls the “largest renewable capacity expansion program in the world.” If India succeeds, according to The Energy and Resources Institute in New Delhi, India will generate 53 percent of its electricity capacity from non-fossil energy sources by 2027, compared with 31 percent today.

The new energy blueprint that Goyal and Modi designed embraces the reality that India can now rely on wind and solar power, and new designs for grid connections and energy storage technology, to achieve that goal. “India is graduating from megawatts to gigawatts in renewable energy production,” said the prime minister.

Indeed, the brightest outlook in India’s energy sector, arguably the only truly encouraging prospect India holds for actually achieving its ambitious economic goals, comes from tapping water-conserving wind and solar resources and developing a much larger domestic renewable energy industry. In the latest edition of India’s national energy statistics, published in 2016, India estimates that the potential generating capacity of the renewable sector is 896.6 gigawatts. Over 80 percent comes from solar.

India’s cleaner, much less water-wasting operating plan has several objectives. The first is to recognize the multiple ecological impediments to fossil fuels and take advantage of domestically sourced, cleaner and lower-cost renewables that don’t use much water. The second is to sustainably strengthen the country’s annual rate of economic growth, which now rests around 6 percent. The third is to position Modi and India at the head of the international movement to slow the effects of climate change, which are now rampant and causing turmoil in India.

In December 2015, Modi joined President Barack Obama and Chinese President Xi Jinping in Paris to guide 196 nations to an international agreement to curb climate-changing carbon emissions. In the days before the Paris agreement was approved, Modi also worked with France and 119 other nations to establish the International Solar Alliance. The group, started with a $US 30 million, five-year grant from India, has a single overarching mission: establish solar power industries in developing nations. “Solar technology is evolving, costs are coming down and grid connectivity is improving,” Modi said in introducing the Solar Alliance in Paris. “The dream of universal access to clean energy is becoming more real. This will be the foundation of the new economy of the new century.”

At Last, A Pragmatic Course on Energy

The change in energy strategy is long overdue. The old strategy is not working well. Decades of pursuing a coal-based electrical sector wrecked India’s countryside, polluted India’s water, made its air unsafe to breathe, killed far too many miners each year and produced endemic corruption from private profiteering. Three years ago the National Green Tribunal, a high court that decides environmental cases, shut down the coal mines of Meghalaya for rampant pollution and safety violations. It was the first time in history that a court had closed a regional coal sector.

In 2013, a vicious Himalayan flood wrecked hydropower dams in Uttarakhand and brought to a halt India’s plan to build more big electricity-generating dams in the world’s most treacherous mountain range. Two years of villainous droughts showed India how vulnerable to water scarcity are its freshwater-cooled coal-fired plants. The country’s nuclear ambitions, meanwhile, are being filleted by unreasonable cost overruns and anti-nuclear opposition.

Having shed much of its allegiance to fossil fuels, India must now prove that it is capable of powering itself with cleaner, water-conserving alternatives. That is no small feat. India’s 2022 renewable energy generating goal is 175 gigawatts, which is 125 gigawatts more than the sector’s current capacity.

India counts on the solar sector to generate 90 of those new gigawatts. Achieving that goal means India would rely on the sun to beat the existing five-year record for new energy-generating capacity. From March 2012 to March 2017, India added 77 gigawatts of new coal-fired capacity, the largest increase of any five-year period in national history.

Minister Goyal told a clean energy conference in Abu Dhabi in January that India would exceed the 90-gigawatt target. “With the advent of new technology in storage, we are poised for huge growth. Solar growth will support landowners to derive income and solar industry to build their business,” he said. “We can manufacture at scale. We need to draw up a regime where government can be an enabler for manufacturing to compete.”

At the heart of it all is this state’s simple, money-making, clean energy-generating formula: “Sun by day. Wind at night. The fuel source is free 24 hours a day.”

More Choke Point: Tamil Nadu

https://www.circleofblue.org/wp-content/uploads/2018/11/2017-01-India-Tamil-Nadu-DMalhotra_C4A7610-2500.jpg

1600

2400

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2018-07-03 15:03:082019-06-24 15:35:12Chennai’s Security Tied to Cleaning Up Its Water

https://www.circleofblue.org/wp-content/uploads/2018/11/2017-01-India-Tamil-Nadu-DMalhotra_C4A7610-2500.jpg

1600

2400

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2018-07-03 15:03:082019-06-24 15:35:12Chennai’s Security Tied to Cleaning Up Its Water https://www.circleofblue.org/wp-content/uploads/2017/05/2015-02_C4A4885-DMalhotra-2500-e1498222900407.jpg

1090

2042

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-06-23 08:52:432018-11-29 14:59:30This is Tamil Nadu

https://www.circleofblue.org/wp-content/uploads/2017/05/2015-02_C4A4885-DMalhotra-2500-e1498222900407.jpg

1090

2042

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-06-23 08:52:432018-11-29 14:59:30This is Tamil Nadu https://www.circleofblue.org/wp-content/uploads/2017/06/2017-01-India-Tamil-Nadu-DMalhotra_C4A6606-2500.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-06-06 15:56:442018-12-04 13:51:22India’s Toxic Trail of Tears

https://www.circleofblue.org/wp-content/uploads/2017/06/2017-01-India-Tamil-Nadu-DMalhotra_C4A6606-2500.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-06-06 15:56:442018-12-04 13:51:22India’s Toxic Trail of Tears https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-KSchneider-51530028-logo-2500.jpg

1262

2048

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-05-31 12:34:282019-04-01 10:41:31Pursuing Riches, Miners Plunder Tamil Nadu’s River Sand

https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-KSchneider-51530028-logo-2500.jpg

1262

2048

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-05-31 12:34:282019-04-01 10:41:31Pursuing Riches, Miners Plunder Tamil Nadu’s River Sand https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-bottled-water-KSchneider-IMG_6676-logo-2500.jpg

1180

2048

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-05-24 13:12:552018-12-04 11:27:01The Right to Life and Water: Drought and Turmoil for Coke and Pepsi in Tamil Nadu

https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-bottled-water-KSchneider-IMG_6676-logo-2500.jpg

1180

2048

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-05-24 13:12:552018-12-04 11:27:01The Right to Life and Water: Drought and Turmoil for Coke and Pepsi in Tamil Nadu https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-Tamil-Nadu-DMalhotra_C4A6151-2500.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-05-12 07:18:152019-06-24 15:35:29In City Prone to Drought, Chennai’s Water Packagers Rush In

https://www.circleofblue.org/wp-content/uploads/2017/05/2017-01-India-Tamil-Nadu-DMalhotra_C4A6151-2500.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-05-12 07:18:152019-06-24 15:35:29In City Prone to Drought, Chennai’s Water Packagers Rush In https://www.circleofblue.org/wp-content/uploads/2017/05/2015-02_C4A5036-DMalhotra-2500.jpg

1366

2048

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-05-03 13:07:132018-12-04 11:19:10Rampage of Water and Social Entrepreneurs Push Chennai to Consider New Growth Strategy

https://www.circleofblue.org/wp-content/uploads/2017/05/2015-02_C4A5036-DMalhotra-2500.jpg

1366

2048

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-05-03 13:07:132018-12-04 11:19:10Rampage of Water and Social Entrepreneurs Push Chennai to Consider New Growth Strategy https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A7108-2500-e1493125279687.jpg

620

1600

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-04-25 07:07:522019-06-24 15:37:01A Torrent of Water and Concrete Imperil Chennai’s IT Boom

https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A7108-2500-e1493125279687.jpg

620

1600

Circle Blue

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Circle Blue2017-04-25 07:07:522019-06-24 15:37:01A Torrent of Water and Concrete Imperil Chennai’s IT Boom https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A5709-2500-1.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-04-19 12:16:272018-12-03 15:03:56Water Scarcity Causes Cauvery Delta Anguish

https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A5709-2500-1.jpg

1667

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-04-19 12:16:272018-12-03 15:03:56Water Scarcity Causes Cauvery Delta Anguish https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A5854-2500.jpg

1439

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-04-11 08:41:062018-12-03 14:58:52Chased by Drought, Rising Costs, and Clean Technology, India Pivots on Coal-Fired Power

https://www.circleofblue.org/wp-content/uploads/2017/04/2017-01-India-Tamil-Nadu-DMalhotra_C4A5854-2500.jpg

1439

2500

Keith Schneider

https://www.circleofblue.org/wp-content/uploads/2018/06/Circle-of-Blue-Water-Speaks-600x139.png

Keith Schneider2017-04-11 08:41:062018-12-03 14:58:52Chased by Drought, Rising Costs, and Clean Technology, India Pivots on Coal-Fired PowerThe conflicting demand for water, food, and energy is one of the defining challenges of the 21st century. Global Choke Point, a collaboration between Circle of Blue and the Wilson Center, explores the peril and promise of this nexus with frontline reporting, data, and policy expertise. “Choke Point: Tamil Nadu” is supported by the U.S. Consulate General in Chennai. Jayshree Vencatesan of Care Earth Trust, Nityanand Jayaraman, and Amirtharaj Stephen provided expertise and invaluable guidance.

Sources: Bloomberg New Energy Finance, Central Electricity Authority (India), Circle of Blue, Community Environmental Monitoring, Enerdata, Frankfurt School of Finance and Management, Ministry of Coal (India), Public Finance Public Accountability Collective, The Times of India, U.S. Energy Information Administration, United Nations Environment Program.

Photo Credits: Used with permission courtesy of Dhruv Malhotra/Circle of Blue. Map and Graphics: Used with permission courtesy of Cody Pope/Circle of Blue.

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider

Related

© 2025 Circle of Blue – all rights reserved

Terms of Service | Privacy Policy