Circle of Blue Investigates: More than 1.5 Million Residential Customers Owe $1.1 Billion to their Water Departments

August 5, 2020

By Brett Walton

Circle of Blue

Margurite McNeill, a Black woman who is 83, lives in a brick-sided, two-story house in Northwest Baltimore that her husband bought a half century ago.

Soft spoken and composed, McNeill recalled changes in the neighborhood. Older neighbors dying, younger people moving in. In the city as a whole, more gun violence and killings. Some of the early stability seemed to be slipping away. “It’s just, everything’s just, different everything,” she said.

Except her water bill until very recently. McNeill never thought much about the utility payment, which was typically about $40 a month. She receives about $1,000 a month from Social Security, and her grandson helps out with finances when needed.

Then two years ago McNeill, for unknown reasons, did not receive a water bill. That lasted for about six months. Around the same time a pipe inside the house sprung a leak that eventually put a hole in the ceiling and rumpled the living room wall. Combined, the billing error and leak proved disastrous.

Margurite McNeill, right, stands with Robin Jacobs, the Maryland Legal Aid attorney who is helping her interact with the Baltimore Department of Public Works over a water bill debt. In the background is City Hall. © Brett Walton / Circle of Blue

Everything got different in a hurry. The next water bill that arrived was for $4,000.

“I almost had a fit,” McNeill told Circle of Blue. “Where am I going to get $4,000 from?”

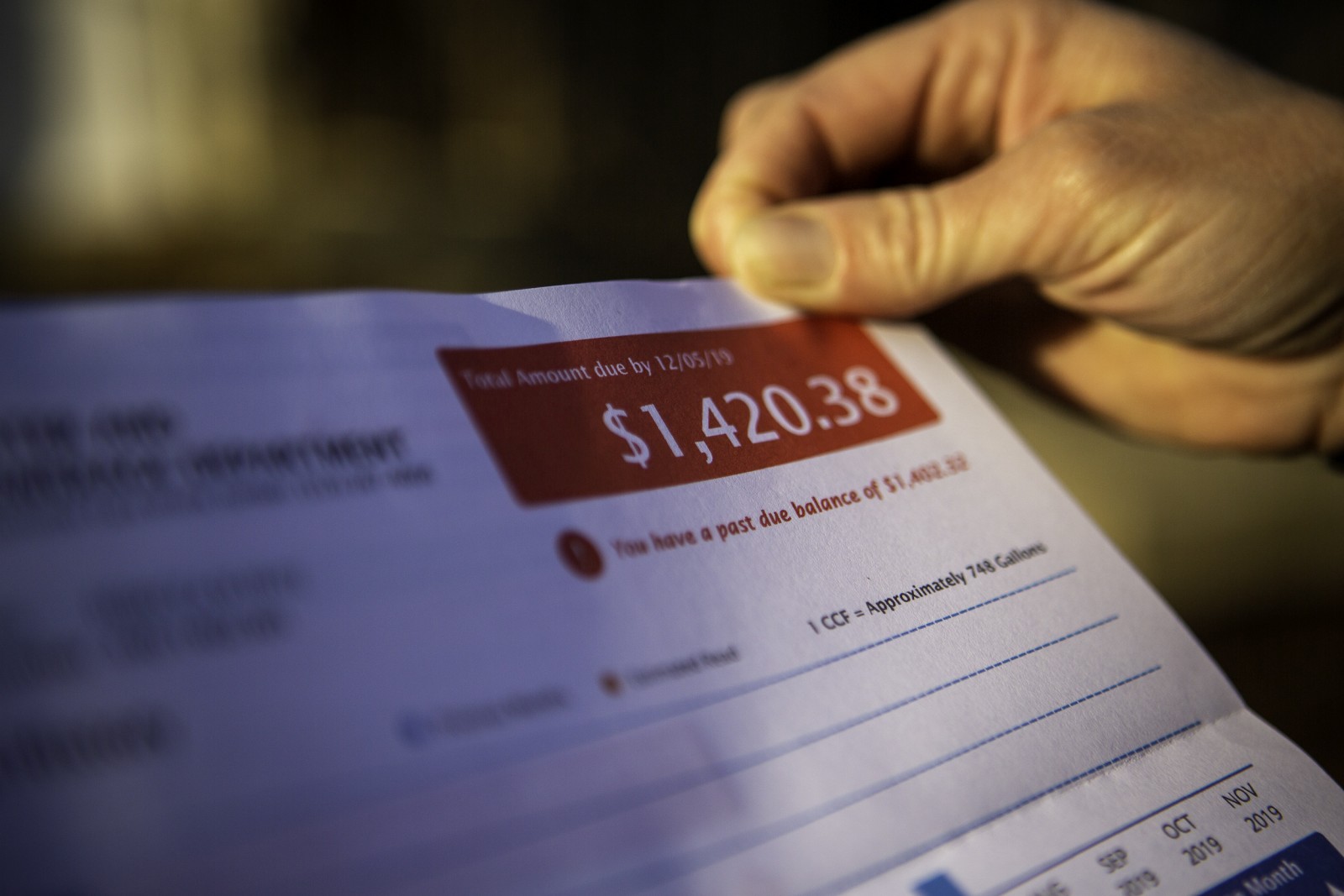

Ayana Pope, who has lived in Detroit for all of her 44 years, had a similar experience. She moved into her current place on the east side of the city in 2019. Twelve family members live in the house: her dad and her kids, plus her grandchildren.

Having so many people at home increases water use. A leak didn’t help. Pope soon found herself several hundred dollars behind on her water payments that year. The water was shut off twice since.

More than 1.5 million households in 12 major U.S. cities with publicly operated water utilities owe $1.1 billion in past-due water bills, according to a Circle of Blue investigation.

Pope received $421 from The Human Utility, a charity, to help with her debt. The water is on now after she paid off about $700 in past-due balances in June, she said. The leak is under control but the external pressures remain. “They keep raising the prices, and people with low incomes, it puts them in a bad predicament,” Pope told Circle of Blue. “I know people who went one and a half years without water. That’s crazy.”

McNeill and Pope are two of the millions of Americans who are in debt to municipal water departments. More than 1.5 million households in a dozen major U.S. cities with publicly operated water utilities owe $1.1 billion in past-due water bills, according to a Circle of Blue investigation. Businesses, industries, and other commercial operations in those cities owed another $416 million.

Most Americans give little thought to water bills, paying them on time and in full. But for a subset of homeowners and renters, water debt is constant and menacing. The burden is an extension of two notable national trends: the rising cost of water service and the general precarity of those at the bottom of the economic pecking order. A missed bill or faulty plumbing can spell financial doom.

In Margurite McNeill’s case it was a pipe leak. In other instances deepening water debt amassed gradually, as part of the monthly grind to make ends meet on poverty wages.

However it accumulated, water debt has serious and potentially long-lasting consequences. It can result in the water department shutting off water to the home. Utilities tack on fees for late payments. To make a claim on payment, some cities use tax liens on the property, a collection method that adds additional fees and can result in foreclosure or the inability to take out a loan for home repairs.

“It makes poor people poorer,” Maria Quiñones-Sánchez, a four-term member of the Philadelphia City Council, told Circle of Blue about the effect of water debt.

Water debt has become so pervasive that The Human Utility raises money to pay overdue bills for people in Baltimore and Detroit. Some utilities have bill assistance programs funded by ratepayer revenue, but others solicit private donations to fund the programs.

City councils and mayoral administrations in Baltimore, Chicago, and Philadelphia go a step further. They ordered their water departments to provide indebted, low-income residents with a path toward clearing out their arrears. The legislation in Philadelphia, which was sponsored by Quiñones-Sánchez, established a novel water-billing system for people near the poverty line. For those enrolled in the program, their water bill is set as a percentage of their income, between 2 and 4 percent. The goal is an affordable bill that prevents debt from accumulating in the first place. Baltimore will soon mimic that system on the orders of its Council.

Rosazlia Grillier, an activist in Chicago, helped spearhead a campaign in her hometown for debt relief and affordable bills. Other goals in this movement include customer service that does not look down upon people, less cumbersome paperwork in applying for assistance, and plumbing retrofits to fix leaks and reduce water use for low-income households. She said these steps are necessary to level the playing field for those at the bottom, especially as the Covid-19 pandemic threatens to undo a decade of economic gains.

“You can’t get blood from a turnip and there’s only so much you can take from people who already don’t have,” said Grillier, co-chair emeritus with COFI POWER-PAC Illinois, an anti-poverty group. “We really need to look at creating systems where the city is sustaining itself and not causing harm to other human beings.”

Rosazlia Grillier, co-chair emeritus with COFI POWER-PAC Illinois, an anti-poverty group, helped spearhead a campaign in her hometown of Chicago for debt relief and affordable bills. Grillier says that expenses such as water bills all add up for people struggling to make ends meet, especially during the pandemic. The city’s new assistance program will help to alleviate some of the crushing financial challenges that residents face by reducing bills and providing debt relief. Photo © Alex Garcia / Circle of Blue

Rosazlia Grillier, co-chair emeritus with COFI POWER-PAC Illinois, an anti-poverty group, helped spearhead a campaign in her hometown of Chicago for debt relief and affordable bills. Grillier says that expenses such as water bills all add up for people struggling to make ends meet, especially during the pandemic. The city’s new assistance program will help to alleviate some of the crushing financial challenges that residents face by reducing bills and providing debt relief. Photo © Alex Garcia / Circle of Blue

Debt Burdens

Water shutoffs in the United States gained public notoriety in 2014 after a mass disconnection operation in Detroit that stemmed from the city’s bankruptcy proceedings. City contractors turned off water to about 30,000 homes that year, prompting an outcry that reached the United Nations.

Despite being a crucial component of household financial insecurity and water access, water debt is largely unexamined by researchers and policymakers.

Less visible but no less important are the financial accounts that underpin the shutoffs. The debt that households accumulate puts them at risk of having their water turned off. Yet debt is a blind spot in the debate about water affordability. Despite being a crucial component of household financial insecurity and water access, water debt is largely unexamined by researchers and policymakers.

“We know so little about this question,” Manny Teodoro, a public policy scholar at Texas A&M University who focuses on water utilities, told Circle of Blue. Teodoro could not recall any academic assessments of customer water debt and said there are no answers for basic questions. “We should know at a minimum what the scope is.”

To better understand the depth and breadth of the problem, Circle of Blue launched the most extensive investigation of water debt and its consequences ever conducted by a news organization in the United States. We spent eight months examining financial data related to customer debt that Circle of Blue requested from water departments in 12 large U.S. cities. The selections were not a random sample. The cities — Atlanta, Chicago, Cleveland, Denver, Detroit, Houston, Los Angeles, Philadelphia, San Antonio, San Francisco, Seattle, and Washington, D.C. — were chosen because they represent a cross-section of America, a mix of geographies, demographics, population sizes, and wealth.

Those data included unpaid bills owed by residential and nonresidential customers; the number of past-due residential and nonresidential accounts; the median past-due balance per account; how long those debts have been outstanding; and debt burdens by ZIP code.

Circle of Blue’s analysis was challenging for several reasons. First, data on debt reflected a point in time, but not the same point for all utilities. Five utilities reported their data from June 30, 2019, the end of their fiscal year. The most recent figures, from Houston, were from May 1, 2020.

Second, some utilities bill for water only, others for water and sewer, and still others include charges for services like garbage collection and stormwater. The debt to the utility reflects all the services for which it bills, even though enforcement generally is the responsibility of the water department. Garbage collectors are not cutting off trash pickup.

Another complication: debt levels are always in flux as some people pay up and others fall behind. Data from Atlanta shows that the Department of Watershed Management collected 99.8 percent of billed revenue in fiscal year 2019, but just 96 percent of billed revenue in 2018. The year before, in 2017, the department pulled in 102.1 percent of billed revenue, meaning that people paid off debts that had accumulated in previous years. Collection rates nationwide are, on average, between 99.5 percent and 97 percent, according to several utility analysts.

Despite the formidable challenges Circle of Blue found striking results. Residential water debt ranged from $341 million in Chicago to only $568,427 in San Francisco. The median residential debt for the eight cities that reported that figure ranged from $79.27 in Denver, to $216.58 in Seattle, to $415.13 in Detroit, to $662.80 in Philadelphia.

“Once you get into a situation where your water bill skyrockets, it’s very hard to get out of that situation.”

Some household debts included in the totals are miniscule and unlikely to be problematic — about 7 percent of the 46,134 past-due residential accounts in Atlanta, for instance, owed $20 or less. The same lack of concern is the perspective of some utilities with low residential debt. The $3.2 million in past-due residential balances in Denver, “have not been a significant issue” and are not factored into rate setting, Todd Hartman, a Denver Water spokesperson, told Circle of Blue.

But too many poor families have debts that reach into the thousands of dollars. Such sums represent crippling financial weights, according to Margaret Henn, director of program management at Maryland Volunteer Lawyers Service, which provides pro bono legal assistance to low-income residents and is frequently involved in housing and utility disputes. Debt can be a self-reinforcing cycle, she said.

“Once you get into a situation where your water bill skyrockets, it’s very hard to get out of that situation,” Henn told Circle of Blue.

Much of America’s drinking water infrastructure is a result of investments made in the previous century. Jardine Water Purification Plant, which began operation in 1964, is the backbone of Chicago’s drinking water system. Photo © Alex Garcia / Circle of Blue

Much of America’s drinking water infrastructure is a result of investments made in the previous century. Jardine Water Purification Plant, which began operation in 1964, is the backbone of Chicago’s drinking water system. Photo © Alex Garcia / Circle of Blue

Times Change

When the McNeills moved into their home in Baltimore in the early 1970s the city and country were in different places than today. Baltimore’s population was 45 percent larger, and it was one of the country’s 10 most populous cities. The U.S. Environmental Protection Agency, then in its infancy, rolled out a grant program that ended up providing $60 billion to modernize the country’s wastewater treatment plants. Roughly the same amount of money each year in that decade went to operating and maintaining water systems as was spent on construction. Water was relatively cheap compared to electric power, heating oil, and gasoline, which were inflated during the oil embargo. Customer water debt, by and large, was not a headline issue for utilities.

Water rates have soared in recent years as the bill for outdated infrastructure has come due.

That dynamic is changing. Water rates have soared in recent years as the bill for outdated infrastructure has come due. Maintenance of existing assets has grown more costly — now more than 2.5 times what is spent on construction. Federal support for water infrastructure, though, has declined steadily in the last four decades as Congress replaced the construction grants programs with low-interest loans.

Industry leaders are starting to recognize water affordability and customer debt as pervasive problems. The American Water Works Association is the water sector’s largest lobby group. Each year it publishes a report on the state of the industry based on survey responses from water managers and other professionals. For the 2019 report, AWWA posed a question for the first time about customer debt.

“In your opinion, is nonpayment of bills a problem for your utility?” the AWWA survey asked. Of the 761 respondents, about 6 percent said that nonpayment was a significant problem. Half, mostly in the Northeast and Southeast, said it was a moderate problem. Risk factors include declining populations, high poverty rates, leaky sewage systems, aging water distribution pipes, infrastructure that was built for a larger city, and expensive water.

City ratepayers are the ones picking up the tab for that expensive water. In Baltimore, which is under a $1.6 billion federal consent decree to fix its sewer system, water prices more than doubled in the last decade. In Las Vegas, Tucson, and San Francisco, prices have also more than doubled. In other cities, poor management of municipal finances has intruded into water bills. Chicago, which had already raised its rates to accelerate the replacement of water distribution pipes, added a bill surcharge in 2017 that goes toward plugging holes in its pension fund. Stories like these are repeated in city after city.

Poor management of municipal finances has intruded into water bills. Chicago, which had already raised its rates to accelerate the replacement of water distribution pipes, added a bill surcharge in 2017 that goes toward plugging holes in its pension fund.

“We’ve seen more concerns expressed about trying to figure out ways to ensure that people have the service and can afford the service,” Doug Scott, a water utility analyst at Fitch Ratings, told Circle of Blue.

Utilities are caught in a bind because of an inherent tension in their operating model. They provide an essential public service — delivering water, removing waste — yet they are expected to function as a business, generating enough revenue to cover costs and invest for the future.

It’s a group effort: utilities rely on customer payments to keep the system operating. The more people who fall behind on their bills, the greater the pressure on the others. If too many people do not pay, there can be a downward spiral in service and reliability. Utilities could see their credit rating downgraded, which increases the cost of borrowing.

“Once you have a high amount of customers not paying their bills it puts a burden on the entire system,” Mohamed Balla, deputy commissioner of finance at the Atlanta Department of Watershed Management, told Circle of Blue.

Utilities are also in a bind because of a data deficiency: few water providers know the financial circumstances of the people who are in debt. Are they poor people who cannot afford the service? Are they wealthier folks who are simply forgetful or negligent? Did they move away and fail to notify the department? When Philadelphia started its income-based billing system in 2017, water department officials said it was the first time they were getting detailed financial information about their customers.

A portion of Atlanta’s debts, as in other cities, are connected to wealthier home owners. ZIP code-level data from Detroit and Houston shows debt spread across poor, middle-income, and richer areas. Researchers from the Pacific Institute found a similar relationship in a different data set. They looked at U.S. Census Bureau data and found that wealthier households received utility shutoff notices at the same rate as low-income households, suggesting that people who are behind on bills are not all poor. Some are merely forgetful or oblivious, which is why utilities argue that the threat of a shutoff is a necessary tool to compel payment.

In Chicago’s Jardine Water Purification Plant, a bank of faucets releases water from various points in the system. Photo © Alex Garcia / Circle of Blue

In Chicago’s Jardine Water Purification Plant, a bank of faucets releases water from various points in the system. Photo © Alex Garcia / Circle of Blue

Difficult Path Out of Water Debt

Within the data there are stories of chronic struggle and complex lives, of frustration and endurance. For people who live in poverty, water debt stories tend to be that way.

Near the Russell Woods neighborhood in Detroit, Rebecca Fritz is a single mother with four children at home under the age of 13. She came into her home seven years ago as a squatter, fleeing an abusive relationship.

When she moved into the empty home, the pipes were busted and water was running across the floor. Because the home had been vacant, she didn’t receive a water bill for three years. She didn’t want to notify the water department because she was broke.

The water department found out in 2015 when social services came to the house to check whether water was running and the bill was being paid. After that visit, the water department installed a meter. Initially, the bill was about $100 a month, said Fritz, who eventually earned the title to the home. Then it rose to $300, which was more than she could handle. “I went from getting it for free, which was based on my income because I didn’t have any, to it being a decent amount that I could afford to pay. Then it just skyrocketed to the point where I went straight into shutoff,” she told Circle of Blue.

Fritz’s water was turned off once in 2018 and twice in 2019. At that point she had enough. Because she couldn’t afford it, she decided to stop paying the water bill. When workers came during a blizzard in November 2019 to turn off the water again, she sat on the valve and refused them access. “I don’t mess around,” she said. “Water is life.”

After they left, Fritz bought insulating foam from a hardware store and sprayed it into the valve. The foam blocks access to the valve for workers who would turn off water. Water remains on, but Fritz still refuses to pay.

“I would like to be on an affordable plan. I’m willing to pay $100 a month or whatever but I’m on welfare, and there’s no way that I can afford to keep going on a vicious circle.”

“I don’t want to be held liable for any of that,” Fritz said, referring to her past-due balance, which is now about $1,600. She is not against paying a little bit for water, but thinks the amount charged is unjust. “I would like to be on an affordable plan. I’m willing to pay $100 a month or whatever but I’m on welfare, and there’s no way that I can afford to keep going on a vicious circle.”

This willingness to pay something, even for those making little money, was a common refrain. Fritz in Detroit; McNeill in Baltimore; Grillier, the organizer in Chicago, all said the same thing. They will pay for water, but will not pay so much that it causes them financial distress. Legal advocates who help low-income clients navigate utility aid programs said this is what they hear, too.

“People want to pay their bills if you can just work with them on the affordability,” said Robin Jacobs, a staff attorney at Maryland Legal Aid who works with clients on housing and utility. “But if it’s not affordable and you’re not willing to work with them on making an arrangement that works for them. They don’t have the resources and the money’s not going to be paid.”

Rebecca Fritz’s water was turned off once in 2018 and twice in 2019. Fritz has four children at home under the age of 13. When workers came during a blizzard in November 2019 to turn off the water again, she sat on the valve and refused them access. “I don’t mess around,” she said. “Water is life.” Photo © Carl Ganter / Circle of Blue

Rebecca Fritz’s water was turned off once in 2018 and twice in 2019. Fritz has four children at home under the age of 13. When workers came during a blizzard in November 2019 to turn off the water again, she sat on the valve and refused them access. “I don’t mess around,” she said. “Water is life.” Photo © Carl Ganter / Circle of Blue

Covid Complications

More people might soon find themselves in that situation.

The data on customer debt were requested and collected, by and large, before the coronavirus pandemic. Since state-mandated lockdowns began in mid-March, financial circumstances for tens of millions of Americans have been upended. The unemployment rate was 11.1 percent in June, and at least 1 million people filed for unemployment insurance in each of the last 19 weeks.

Seeing the economic carnage unfolding, many water utilities, regulators, and governors moved in March and April to shield customers from immediate financial disaster. Most utilities stopped shutting off water for unpaid bills and they suspended the fees they charge for late payment. They offered extended repayment terms for people in debt, giving them more months to pay off their bills.

Congress, acting with unusual speed and decisiveness, boosted the earnings of laid-off workers by increasing unemployment benefits by $600 per week and distributing $1,200 per adult for individuals whose income was less than $99,000, and $500 per child under 17 years old — or up to $3,400 for a family of four.

The assistance and payment moratoriums were designed to be temporary, meant to last for the duration of the public health emergency. Now that states are reopening, the repayment rules are under review. Gretchen Whitmer, the governor of Michigan, extended the moratorium in her state through the end of 2020. But in other jurisdictions, prohibitions on shutoffs and late fees have started to be withdrawn. The $600 increase in weekly unemployment insurance expired at the end of July. Water bills that went unpaid in April, May, and June will eventually come due.

The upshot is that customer debt levels are likely worse now than they were before the pandemic, said Greg Pierce, who researches water access and affordability as the associate director of the UCLA Luskin Center for Innovation.

“Absolutely, yes,” Pierce told Circle of Blue. “There is no way to envision it not being a bigger problem than before.”

John Mastracchio, a vice president at the water consulting firm Raftelis, also sees it that way. Mastracchio led a financial analysis of the impact of the pandemic on water utilities. His conclusion is that more people will be unable to pay their bills.

“We’re expecting a significant uptick in write-offs,” Mastracchio told Circle of Blue. How much of an uptick? The report estimated that 6 percent of billed revenue will not be paid. That average figure is based on rising unemployment and the moral hazard of some people who can afford to pay taking advantage of prohibitions on shutoffs and fees. The figure is also informed by experience in Seattle, which saw a rise in nonpayment from 1.5 percent to 5 percent in 2016-17, when Seattle Public Utilities suspended shutoffs while it switched to a new billing system.

It’s clear that more people are struggling. The United Way of Greater Houston, which covers four counties in the metro area, told Circle of Blue that 6,096 people called its 211 helpline between March 1 and July 22 asking for water bill assistance, a 35 percent increase over the same time period in 2019.

Contractors for Houston Public Works work on a wastewater and drainage project in the Greater Eastwood neighborhood. Pipe repairs are a significant cost for water utilities and contribute to an increase in water and sewer rates. Photo © Elizabeth Conley / Circle of Blue

Contractors for Houston Public Works work on a wastewater and drainage project in the Greater Eastwood neighborhood. Pipe repairs are a significant cost for water utilities and contribute to an increase in water and sewer rates. Photo © Elizabeth Conley / Circle of Blue

Where Does Aid Come From?

The pandemic has resurfaced a debate that simmered in Congress for the last five years: what is the federal role for aiding individuals with their water bills?

Utility representatives, witnessing municipal and state budget shortfalls amid a cratering of tax revenue, are certainly in favor of federal support.

Sophia Skoda, the chief financial officer for East Bay Municipal Utility District, in California, said that Congress needs “to step up to its responsibility” to ensure that water and sewer service is affordable for all people.

“People are struggling to have a roof over their head,” Skoda said. “One more cost is pushing people into deeper debt and stress.”

House Democrats have shown the most consistent support in Congress for water bill assistance. They included $1.5 billion for that purpose in the Heroes Act, which the House passed in May. Senate Republicans offered $1.5 billion for energy bill assistance, but nothing for water.

Rep. Dan Kildee, a Democrat who represents Michigan’s Fifth District, told Circle of Blue that he supports a two-pronged approach. In the near-term, to prevent water shutoffs during the pandemic he suggested using the State Revolving Funds — two low-interest loan funds for water and sewer infrastructure — to channel money to utilities. The money would replace revenue from customers who are late on their bills, to cover their debts. The benefit to using the revolving funds as the distribution mechanism, Kildee said, is that the administrative structure is already in place.

In the longer-term, Kildee wants federal aid for water bills akin to the federal program for energy bills that Congress established in 1981. The Low-Income Home Energy Assistance Program provided $3.7 billion in 2020 for household heating and cooling costs and for energy-efficient repairs. Congress added $900 million to the program in the CARES Act, which was signed into law on March 27, 2020.

“Congress needs to act to make water more affordable for people,” Kildee wrote in a statement. “Access to clean drinking is a human right. In the richest country in the world, too many people in America do not have access to affordable and clean drinking water. Since states are not stepping up to provide affordable clean drinking water, the federal government must act.”

Utilities, where they can, are filling some of that gap. The standard practice is through customer assistance programs that provide discounted rates for elderly and low-income residents.

Some go several steps farther. Houston Public Works has an alert system that notifies customers about spikes in water use that might be connected to a leak. The department also participated in a National League of Cities pilot program that provided financial coaching to low-income residents. Program participants were more likely to pay bills on time. Atlanta’s Care and Conserve Program provides not only financial assistance but also plumbing repairs for low-income households. The idea is to “get the customer back in good payment standing with a bill that is predictable, manageable and is paid on time,” Balla said.

The problem is that many of these assistance programs reach only a small portion of the people who are eligible.

The Baltimore Department of Public Works is another utility that allows for senior discounts and bill adjustments if the customer can prove the leak and show evidence of repairs.

Robin Jacobs, the attorney with Maryland Legal Aid who is guiding Margurite McNeill through the paperwork gauntlet, described the process as “difficult to understand” because the department has changed it so frequently.

“Finding out exactly what is happening is even difficult for me as an attorney,” Jacobs said.

Jacobs’ intervention convinced the department to cut $2,400 from the $4,000 debt, and she arranged for a $200 monthly payment plan, which will take care of the balance.

For now, McNeill is making do with payments that are stabilized, but higher than what she was used to. Unlike many in her situation, she had a lawyer to help sort out the mess. Her water debt is diminished, but remains a weight. Once Baltimore enacts its forgiveness plan, possibly by next summer, McNeill and others in the city like her will have a less financially arduous path to eliminating their debts.

Until then, McNeill is resolute, committed to squaring her accounts.

“I try to pay everything I’m supposed to pay,” she said.

Editor’s note: This story was updated on August 5, 2020, after receiving data from the Philadelphia Water Revenue Bureau.

Photography:

Alex Garcia

Elizabeth Conley

J. Carl Ganter

Data Visualizations:

Claire Kurnick

Joe Warbington – Vizlib

Reporting for this article was supported in part by the Society of Environmental Journalists.

Stay informed about global WaterNews and never miss any of Circle of Blue’s award-winning reporting by joining our weekly newsletter.

Have new, international water news delivered to you daily by signing up for Circle of Blue’s The Stream.

Signup for the Federal Water Tap, Brett Walton’s weekly digest of U.S. government water news.

Brett writes about agriculture, energy, infrastructure, and the politics and economics of water in the United States. He also writes the Federal Water Tap, Circle of Blue’s weekly digest of U.S. government water news. He is the winner of two Society of Environmental Journalists reporting awards, one of the top honors in American environmental journalism: first place for explanatory reporting for a series on septic system pollution in the United States(2016) and third place for beat reporting in a small market (2014). He received the Sierra Club’s Distinguished Service Award in 2018. Brett lives in Seattle, where he hikes the mountains and bakes pies. Contact Brett Walton